About

SOCAR Trading is the trading arm of the State Oil Company of Azerbaijan Republic (SOCAR). This sovereign-owned business markets SOCAR crude oil export volumes, trades third party crudes and oil products, and manages international investments in downstream.1

Headquartered in Switzerland, SOCAR Trading operates from offices in all major commodity trading hubs across the world. SOCAR Trading’s treasury, based in Dubai, manages time-sensitive cash flow movements for the group through a complex bank account structure, setup across multiple jurisdictions.

In recent months, SOCAR Trading has invested considerable time and resources in risk management, control and compliance, spearheaded by the implementation of sophisticated IT support systems.

The challenge

- As a global Oil & Gas trading business, SOCAR Trading requires access to real-time information on its global cash position in order to make informed cash management decisions and execute time-sensitive payment transactions with efficiency

- The company needed an easy-to-implement solution that provided balance and transaction reporting across all of SOCAR Trading’s bank accounts with J.P. Morgan. Microsoft Excel® is used extensively in SOCAR Trading’s treasury and the company is deploying Microsoft Dynamics® (Enterprise Resource Planning software) across its global business

- SOCAR Trading was looking for a reporting tool that allowed for customization of data and easy integration into its treasury and cash management technology architecture. Furthermore, the company was also adjusting to newly-identified remote working needs, as a result of COVID-19

The solution

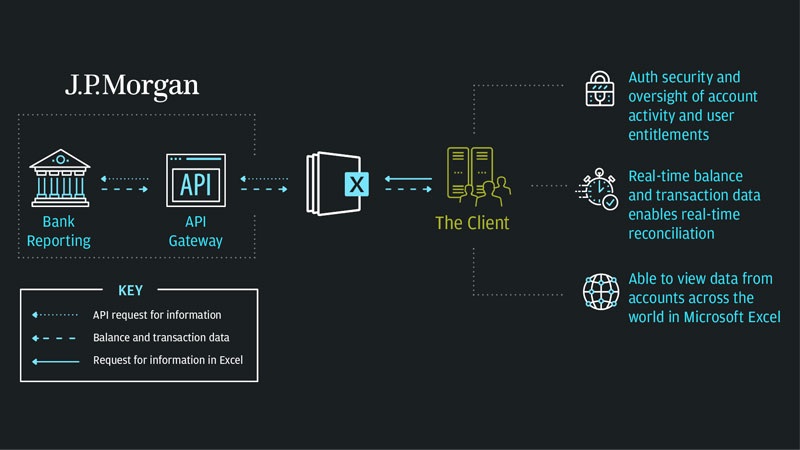

J.P. Morgan equipped SOCAR Trading with our Insight API solution, a Microsoft Excel® plugin. APIs facilitate the sharing of data between two or more systems and this solution uses the J.P. Morgan Treasury Services API as the foundation for sharing real-time, on-demand data from J.P. Morgan systems.

“J.P. Morgan’s Insight API solution provided us with the agility, transparency and adaptability we needed to access timely information on our cash balances and other bank data. We are pleased to have partnered with J.P. Morgan to become early adopters of API for our business”

Clement Briquetti

Group Head of Treasury, SOCAR Trading

The results

- Insight API provides pre-configured, end-to-end solutions for cash visibility, user management and payment reporting; enabling SOCAR Trading to view its global bank data on local desktops

- Resources required by SOCAR Trading to implement the solution were minimal. The API plugin was installed in just a few simple steps, meeting their need for a speedy implementation

- Once installed, SOCAR Trading gained immediate access to real-time data on its account balances and transactional activity. User statuses and entitlements on Access Online, J.P. Morgan’s global cash management platform, are also straightforward to view

- The requirement to work remotely in 2020 meant the solution had to be simple and easy to access. The use of preconfigured templates meant that SOCAR Trading had real-time visibility on MS Excel without the operational burden of logging into an external portal, meeting the client’s resiliency remote work needs

To learn more about how we can support your business, please contact your J.P. Morgan representative.

Unilever also employed the Insight API plugin to build a real-time treasury: It gave them on demand access to 130 accounts in just 10 days.

J.P. Morgan is the marketing name for the Wholesale Payments business of JPMorgan Chase Bank, N.A. and its affiliates worldwide.

The products and services described in this document are offered by JPMorgan Chase Bank, N.A. or its affiliates subject to applicable laws and regulations and service terms. Not all products and services are available in all locations. Eligibility for particular products and services will be determined by JPMorgan Chase Bank, N.A. or its affiliates.

All rights reserved. JPMorgan Chase Bank, N.A.