The world in which companies are operating is changing rapidly and the surprises and uncertainty that characterized 2016 for cash management and payments are continuing this year. While the fundamentals of the treasurer remain the same, treasury models are being re-evaluated.

With so many factors now impacting business quicker than ever, there is an increasing understanding that agility and speed are crucial if a firm is to effectively manage its liquidity in an ever-changing environment. Flexibility is also needed within centralized treasury structures in order to be able to react appropriately to local circumstance and needs.

J.P. Morgan has identified priorities and key areas of focus for treasurers where they will need to be agile and flexible in order to enhance their level of success.

Politics and protectionism

-

Geopolitical events, whether it’s Brexit, President Trump’s new administration, or other elections across around the world, have paved the way for a political environment that’s increasingly conservative and protectionist in nature.

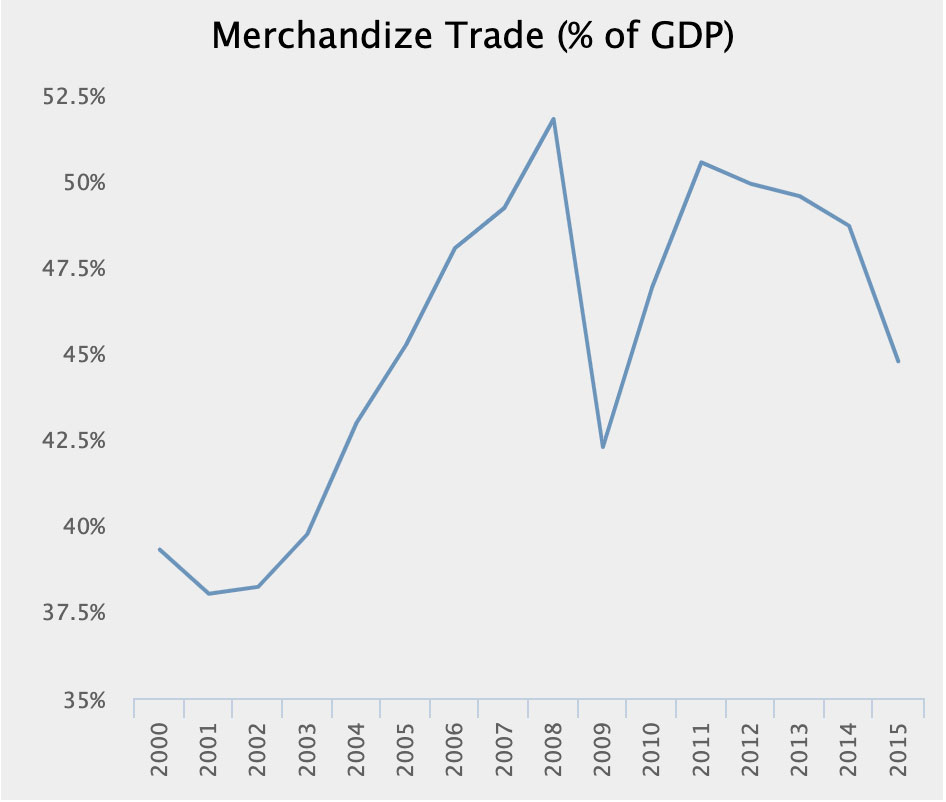

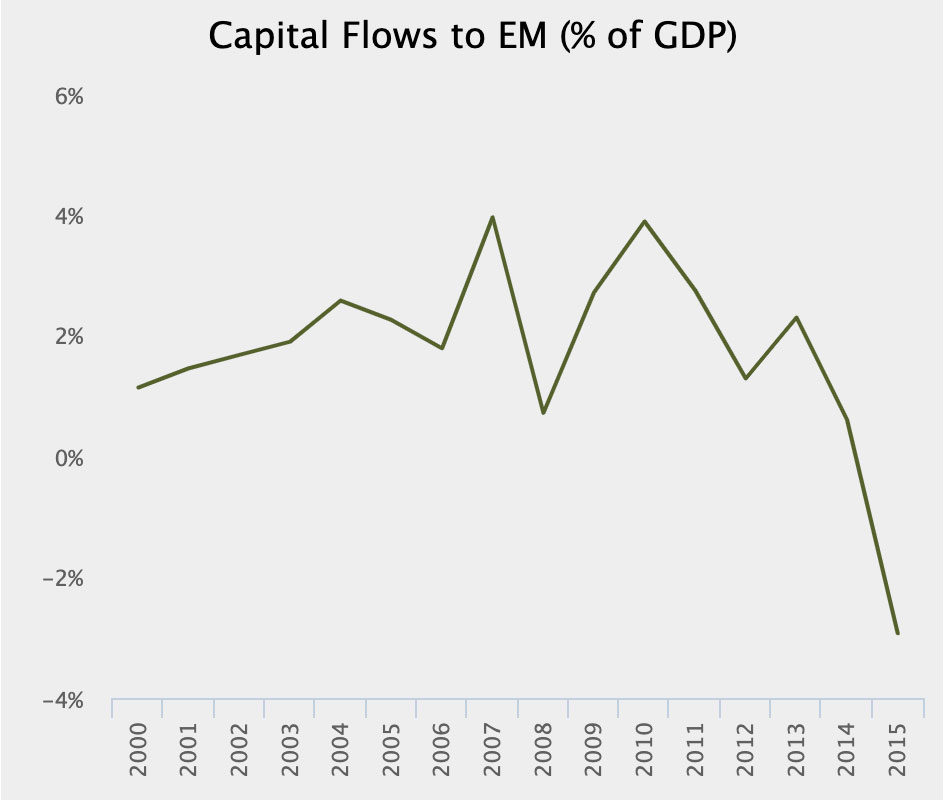

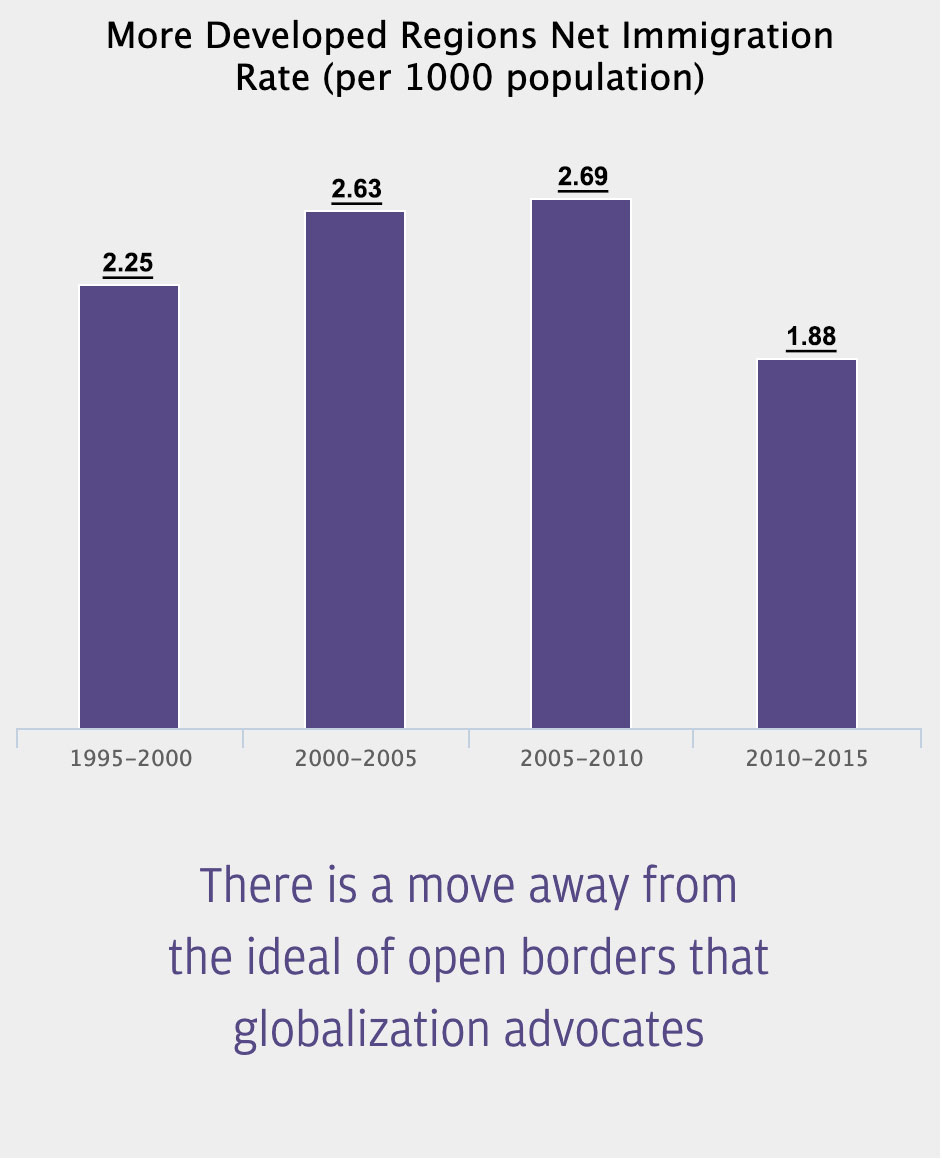

The charts below illustrate a drop of 6-7% in merchandise exports since its peak in 2008, falling foreign direct investments into emerging markets and a pronounced decline in the number of people migrating to the developed markets. The drivers of globalization have slowed and the current geopolitical climate could see this trend exacerbated.

Failing global trade

Emerging Market (EM) capital flows

More restricted labor flow with tighter immigration criteria

Priorities for treasurers

Treasurers will need to stay abreast of policy changes and evaluate how to adjust processes, structures and locations.

Regulations and operating procedures in each country should be reviewed frequently to ensure that treasury operations are market-compliant in addition to being market-responsive.

The trend towards protectionism could see supply chains revisited and trade agreements changed, so treasurers would need to embrace cash management frameworks that provide flexible and dynamic solutions.

Source: World Bank; World population prospectus; IMF BoPS annual data

Notes: 1More developed regions comprise Europe, Northern America, Australia/New Zealand and Japan; 2Capital flows refer to net private flows which include net FDI, portfolio, and other flows and exclude IMF lending; Emerging markets countries included: China , Indonesia, India, Korea, Malaysia, Philippines, Taiwan, Thailand, Argentina, Brazil, Chile, Colombia, Mexico, Czech Republic, Hungary, Poland, Romania, Russia, Israel, South Africa, Turkey

Changing regulatory environment & FX volatility

The post-financial crisis environment has led to increasing regulatory requirements to ensure that banks around the world – as intermediaries for cash transactions – are safer institutions and partners to treasurers. Basel III, structural changes to the regulations of money market funds and enhanced Know Your Client (KYC) procedures are some examples.

In addition, rising interest rates in the U.S. in contrast to the easing of monetary policies elsewhere has seen the U.S. dollar strengthening against many currencies. This has resulted in authorities across Asia Pacific imposing tighter FX policies and capital controls as they attempt to stabilize their own currencies and reduce FX volatility. China’s window guidance and Malaysia’s FEA rules are examples of measures governments have taken to develop the local financial market.

Increased regulatory climate in Asia Pacific

- China has increased its focus on outward bound capital transfers, for example, by requiring the registration of cross-border RMB lending and reducing the cross-border RMB payment-to-collection ratio.

- Malaysia has established hedging and FX measures to promote the development of the Malaysian Financial Market: residents must now settle domestic payments in Malaysian Ringgit (MYR), and exporters must convert 75% of overseas proceeds at minimum into Malaysia’s currency, with limits on hedging FX exposures.

- Indonesia now requires supporting documents for outgoing transfers in foreign currency above US$100,000 or equivalent.

- India has demonetized high-value notes in an attempt to deal with the issues of unaccounted income and counterfeiting.

Priorities for treasurers

In-depth cash flow analysis will provide treasurers with improved visibility and enable them to accurately determine optimal cash requirements. They will be able to implement regional and local liquidity structures that support these needs by utilizing solutions such as notional pooling and Just-In-Time funding.

To address FX risk management, treasurers can turn to natural hedging, intercompany lending, netting across currencies, and tapping into local currency financing. Corporates can also manage fungible/G10 currencies centrally, to benefit from scale and yield optimization while allowing local currencies to be managed with local or regional autonomy.

While long-term funding should remain centrally managed, companies with foreign currency exposures can capitalize on attractive local currency financing to match local assets with local liabilities.

Partner closely with internal stakeholders and external advisors / banks to stay abreast of market change.

Technology revolution

Developments in technology continue to transform traditional banking systems and reshape the value proposition of existing services that are delivering significant benefits to treasury.

The current key FinTech applications at banks include Robotics Process Automation (RPA) to remove risks associated with manual repetition and boost operational efficiency, and Blockchain (Distributed Ledger) Technology to enable payments on a single, tamper-proof ledger.

Priorities for treasurers

Treasurers need to watch how robotics, blockchain, API and cloud technology can be used to drive operational and cost efficiencies, connectivity, transparency, speed, security and standardization where appropriate.

They must embrace big data that involves machine learning and predictive analytics. This will make it possible to be more accurate in cash forecasting which results in less buffers required in funding and liquidity management.

As technology develops, cyber attacks will continue to increase in frequency and sophistication. Treasury will need to collaborate across the organization both regionally and locally to mitigate immediate risk while still building for future growth. Technology and Operations partners are natural allies, and AML, legal/compliance, client service and implementation teams can add tremendous value.

Key takeaways for treasurers

Treasurers will need to stay abreast of policy changes and evaluate how to adjust processes, structures and locations as a result of them.

In depth cash flow analysis will provide treasurers with improved visibility so enabling them to accurately determine optimal cash requirements in all markets.

Understanding how robotics, blockchain, API and cloud technology can be used to drive operational and cost efficiencies, connectivity, transparency, speed, security and standardization is becoming increasingly important.

Collaborating across the organization, both regionally and locally will help mitigate immediate risk while still building for future growth.

Consider leveraging modular solutions that are configurable to cash, liquidity and risk management needs.

At J.P. Morgan, we believe in closely supporting and collaborating with our corporate clients. As a leading global financial institution we have strong regional presence with deep local expertise. J.P. Morgan is able to offer exceptional client servicing and implementation support as we help protect, manage and grow our clients’ businesses.

To learn more, please contact your J.P. Morgan representative.