Among German business leaders, labour challenges, business costs and supply chain woes are top of mind heading into the second half of 2022.

Executives at midsize businesses across Germany believe the continued war in Ukraine will impact the region, energy prices and supply chains. In its second year, the J.P. Morgan Business Leaders Outlook: Germany survey of companies with revenues between €20 million and €2 billion found that German business leaders continue to remain resilient.

"While the business environment may be uncertain for the foreseeable future, we know and continue to see that the Mittelstand community is strong and will keep pushing their businesses forward."

Stefan Povaly

Head of Germany, Senior Country Officer, J.P. Morgan

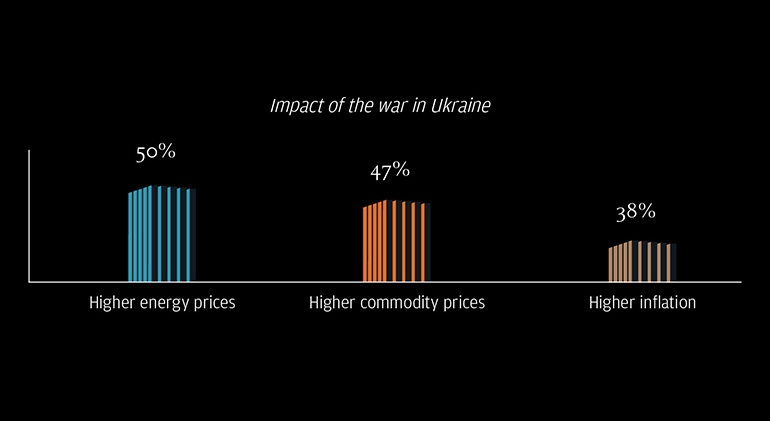

Our initial survey fielded responses in March 2022, right as Russia’s invasion of Ukraine began. Because the situation has since intensified and continues to create regional and global ramifications, we conducted a follow-up survey in May 2022 to gauge how business owners’ views had changed. The new responses indicate that leaders are more concerned about rising prices and labour concerns than they were earlier in the year. It also reflected new expectations that the war in Ukraine will be much longer than initially expected.

Fuel for concern

The May survey asked how business leaders were feeling the ramifications of Russia’s invasion of Ukraine. About six in 10 executives surveyed expected the war to have an impact on their own businesses, as the conflict adds to energy costs, snarls supply chains and erodes bottom lines.

© 2022 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.