For Companies and Institutions

-

Commercial Banking

We provide credit, financing, treasury and payment solutions to help your business succeed. We also offer best-in-class commercial real estate services for investors and developers.

-

Global Corporate Banking

We help clients achieve their long-term strategic goals through financing, liquidity, payments, risk management and investment banking solutions.

-

Investment Banking

Providing investment banking solutions, including M&A, capital raising and risk management, for a broad range of corporations, institutions and governments.

-

Institutional Investing

We support the entire investment cycle with market-leading research, asset management, analytics, execution, and investor services.

-

Payments

Your partner for commerce, receivables, cross-currency, working capital, blockchain, liquidity and more.

Key Links

For Individuals

-

Wealth Management

With J.P. Morgan Wealth Management, you can invest on your own or work with an advisor to design a personalized investment strategy. We have opportunities for every investor.

-

Private Bank

A uniquely elevated private banking experience shaped around you.

Explore a variety of insights.

Key Links

Insights by Topic

Explore a variety of insights organized by different topics.

Key Links

Insights by Type

Explore a variety of insights organized by different types of content and media.

Key Links

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key Links

- Insights

- Sustainability

- Four ways treasury teams can make an impact on sustainability

Make your mark on sustainability

Developing a holistic sustainability strategy starts at the top, filtering down through the organization. As an important piece of the bigger puzzle, treasury teams have a unique opportunity to make an impact on company initiatives.

So… how can you drive results that go far beyond point solutions?

1. Establish ESG priorities

Executives set the direction, and treasury teams keep the company on course. Advance sustainability efforts by aligning financial incentives to treasury activities such as lending facilities, trade structures and short-term investments.

2. Develop sustainable supply chain finance programs

Grant access to improved funding costs for suppliers that join supply chain finance programs and score highly on external ESG scorecards.

3. Advance financial inclusion

Ramp up social inclusion efforts through access to on-demand wage access for employees and pre-shipment financing to minority-owned businesses.

4. Accelerate decarbonization efforts

Deliver carbon neutral/offsetting solutions that assist your clients in their global decarbonization agenda.

We take a distinctive approach to ESG that goes beyond point solutions, developing a holistic strategy for your business – all backed by firmwide commitments and unmatched advisory and expertise.

Together, let’s dig deeper than surface level to drive real outcomes – to support sustainability in your industry and in your communities.

Connect with your J.P. Morgan representative to find the right solution for your business.

Incorporating ESG into Supply Chain Finance

The adoption of ESG goals brings an increasing demand for accountability and transparency. Supply chain finance can be used to create financial incentives and reduce the cost of doing business.

Get the full insights on incorporating ESG into Supply Chain Finance

ESG at J.P. Morgan

Learn about our approach to ESG in driving long-term environmental and social sustainability for our clients, employees and the communities we serve.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of J.P. Morgan, its affiliates, or its employees. The information set forth herein has been obtained or derived from sources believed to be reliable. Neither the author nor J.P. Morgan makes any representations or warranties as to the information’s accuracy or completeness. The information contained herein has been provided solely for informational purposes and does not constitute an offer, solicitation, advice or recommendation, to make any investment decisions or purchase any financial instruments, and may not be construed as such.

JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

Related insights

Sustainability

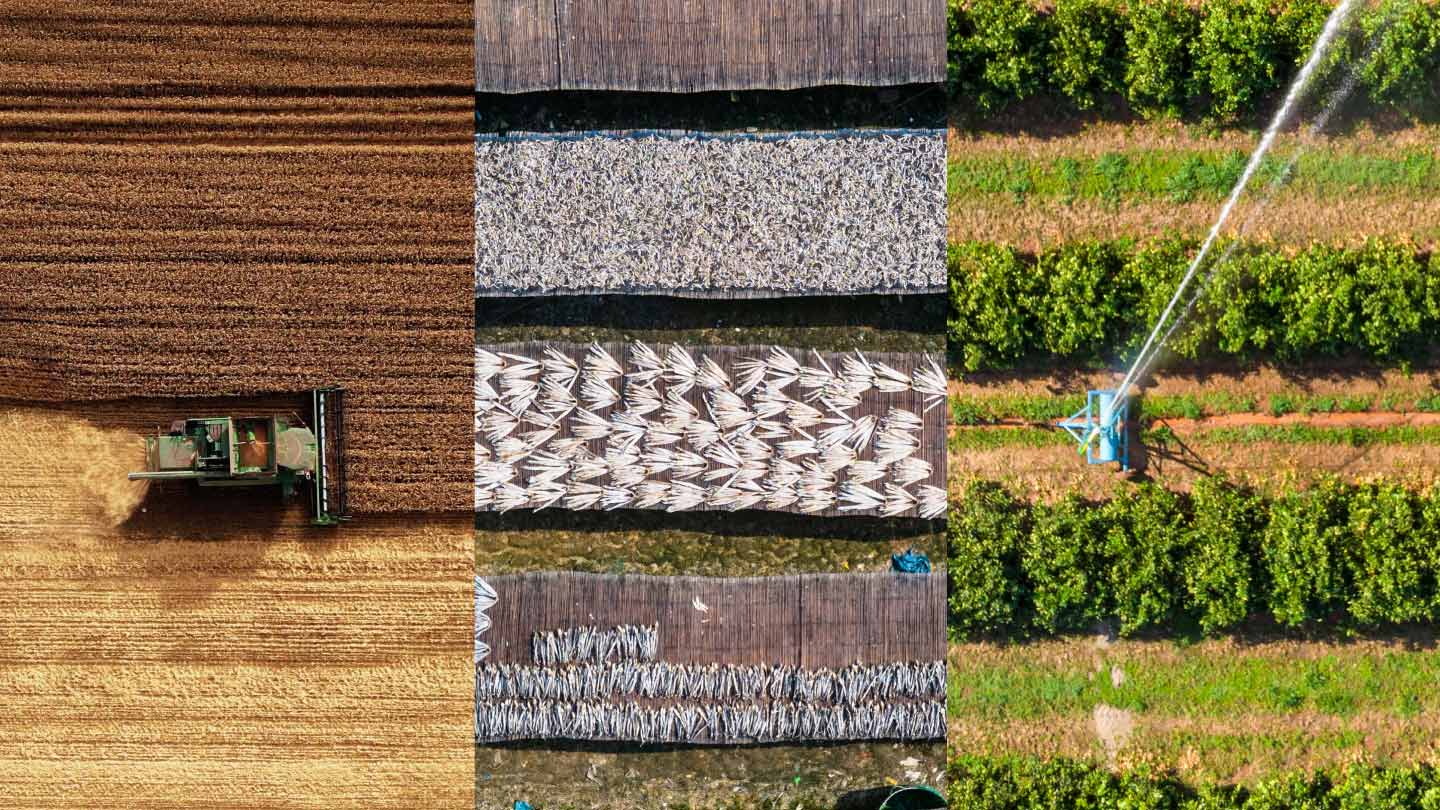

Climate Intuition: Food security: The fates of farming and food in a warming world

Jan 16, 2026

Countries and corporations that rely on agriculture are being forced to adapt to a changing climate, environmental threats and shifting market and trade dynamics.

Sustainability

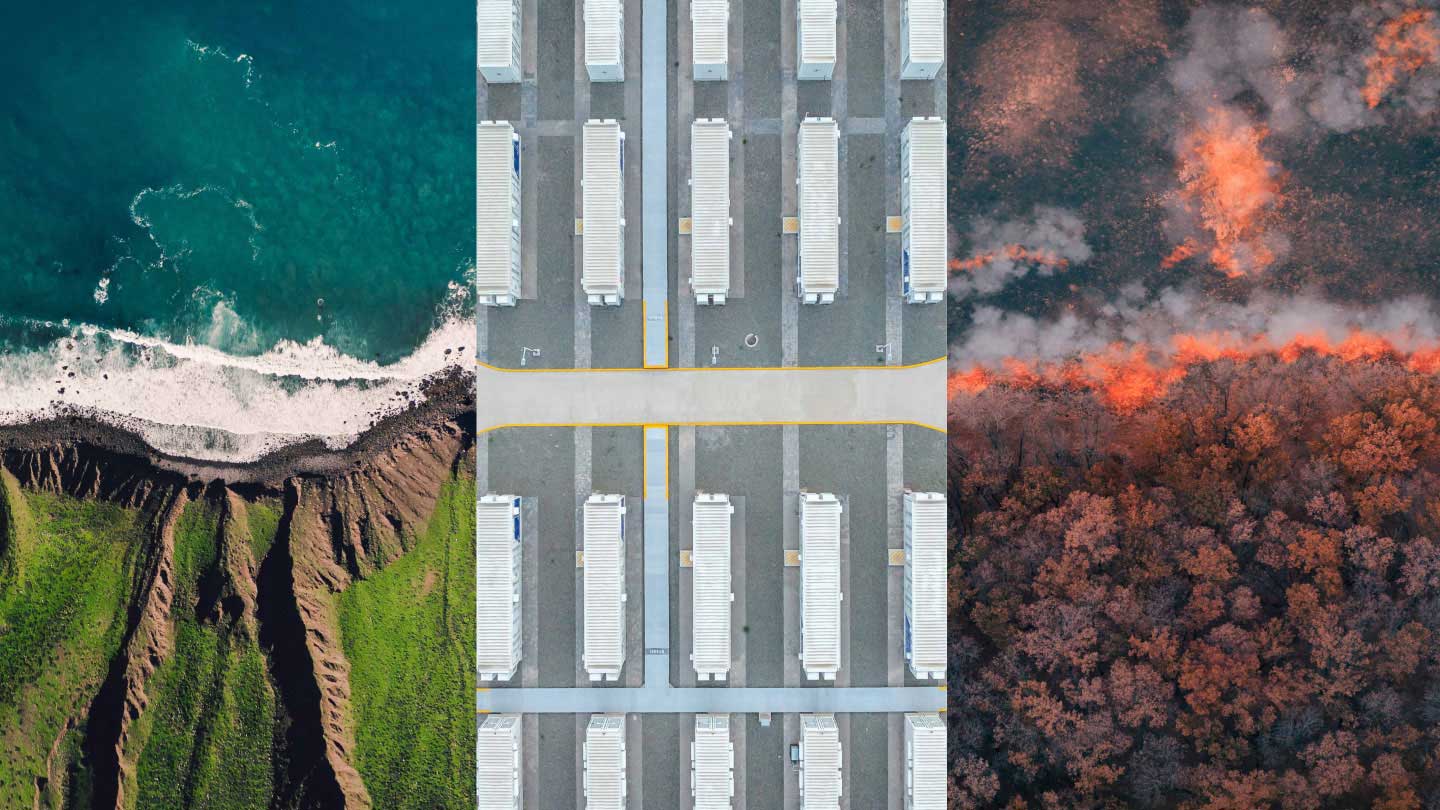

Climate Intuition: Resilience: Where Climate Change and National Security Meet

Nov 21, 2025

In the new climate-security era, resilience is a strategic asset

Sustainability

Climate Intuition: Power Rewired: The new map of energy and geopolitics

Sep 16, 2025

Explore the transformative shifts in global energy and geopolitical dynamics and their impact on investment.

Sustainability

Pioneering deal for carbon removal: J.P. Morgan leads project financing for Chestnut Carbon

Aug 12, 2025

The credit facility is the first of its kind in the voluntary carbon market.

Sustainability

How businesses can navigate climate challenges with adaptation

Jul 25, 2025

In this Q&A between Robert Keepers, head of Climate Tech for J.P. Morgan, and Dr. Sarah Kapnick, global head of Climate Advisory at J.P. Morgan, we uncover why investing in climate adaptation is emerging as a forward-thinking action to realizing returns.

Banking

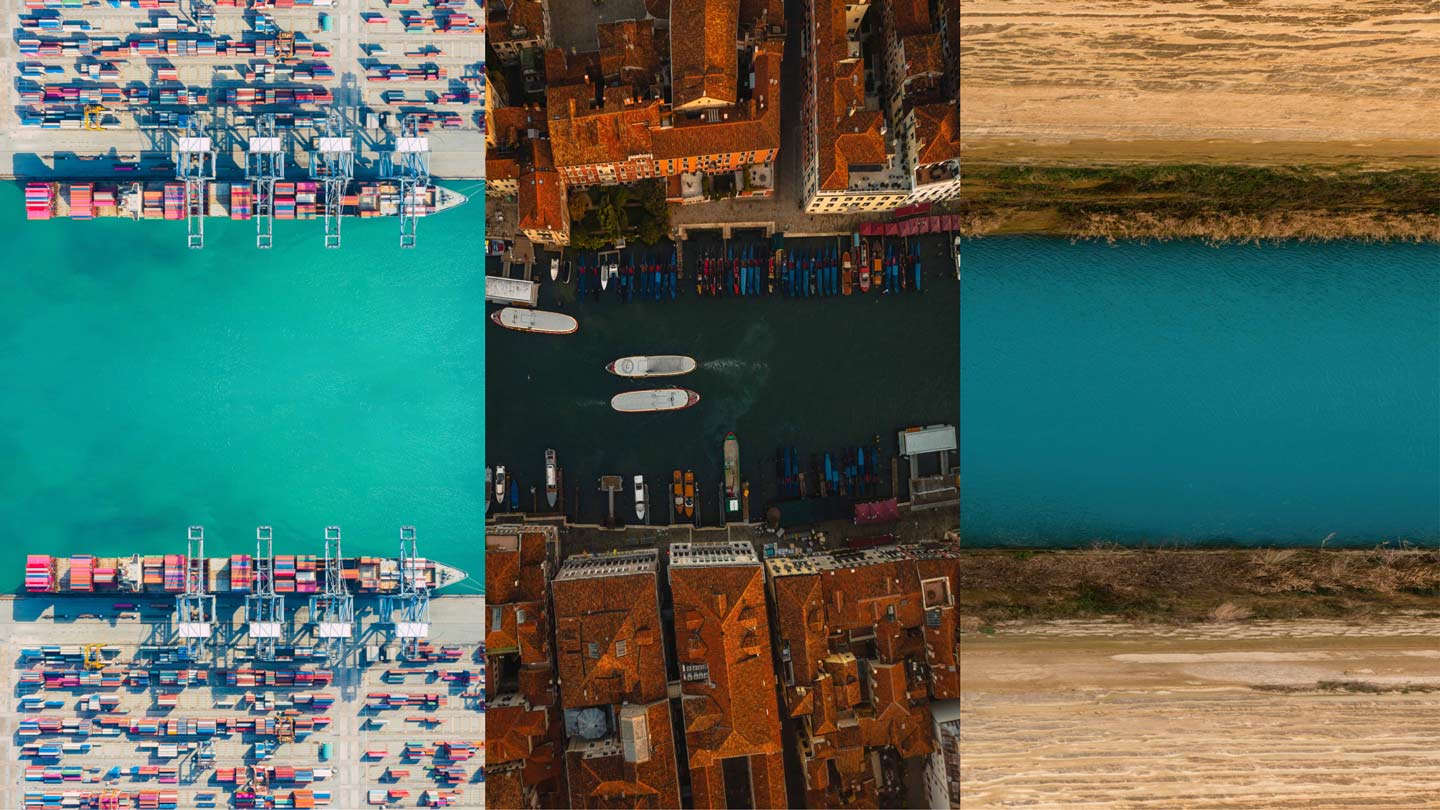

Climate Intuition: Future-proofing ports for climate and trade evolution

Jun 16, 2025

Discover the pivotal role of ports in global trade and the urgent need for strategic investment to mitigate climate risks.

Sustainability

J.P. Morgan Clean Tech Stars Conference

May 16, 2025

This conference brings together companies that are leading the way to find solutions and technologies for the world to address the evolving landscape of sustainable finance.

Sustainability

Nuclear’s new chapter: Opportunities and challenges

May 14, 2025

Where is nuclear power headed? In this newsletter from the Green Economy Banking team, we share key trends in nuclear power production, investment and policy.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.