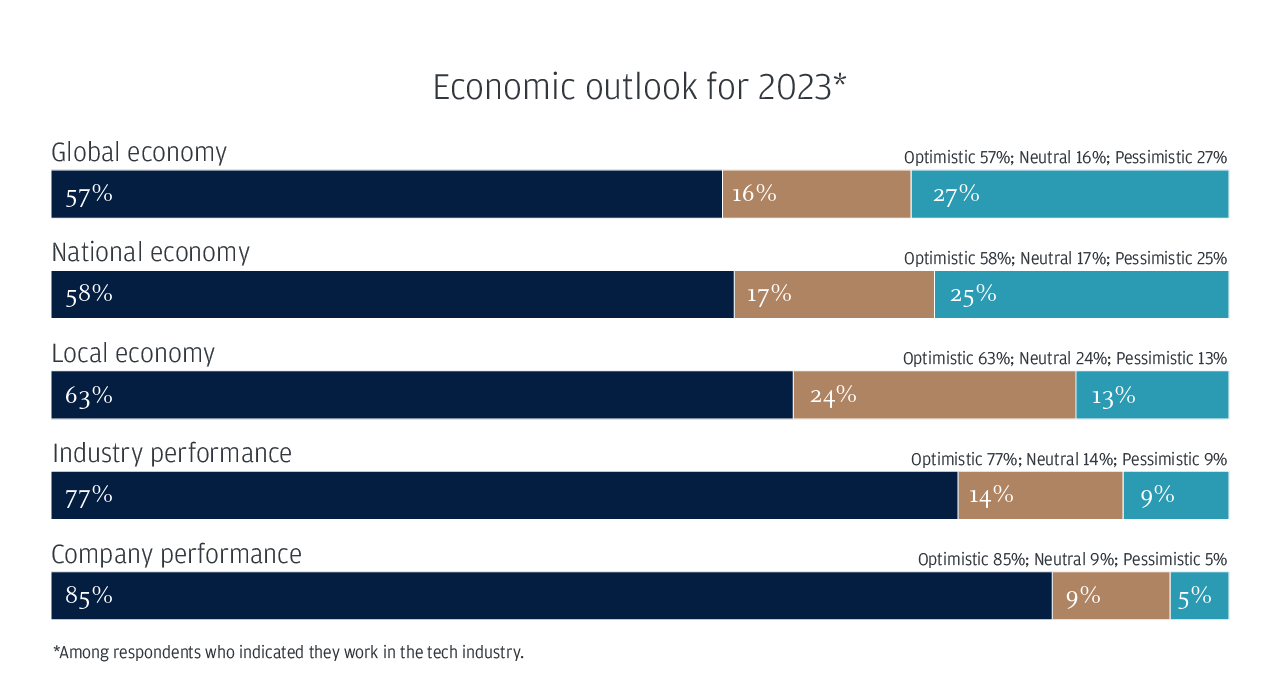

Midsize tech industry leaders are more optimistic about the year ahead than U.S. executives overall, according to our 2023 Business Leaders Outlook survey.

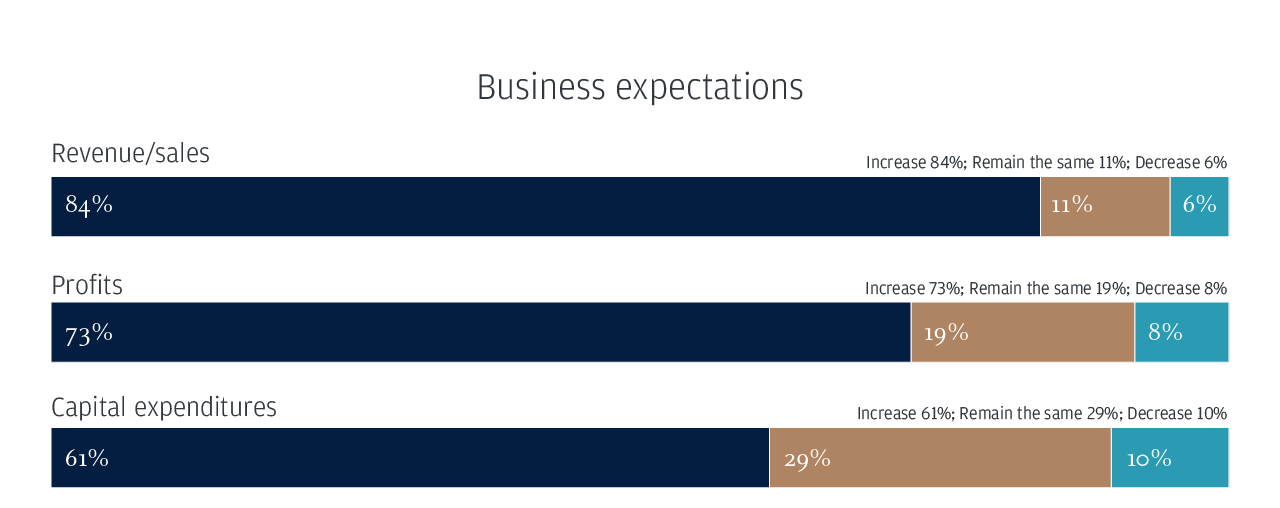

Most tech leaders are positive about the global (57%), national (58%) and local (63%) economies—all at significantly higher rates than midsize U.S. business leaders in general. More than three-fourths (77%) are also optimistic about their industry’s performance in 2023, with 85% optimistic about their own company’s performance. And the majority of tech leaders surveyed expect increases in their revenue/sales (84%) and profits (73%).

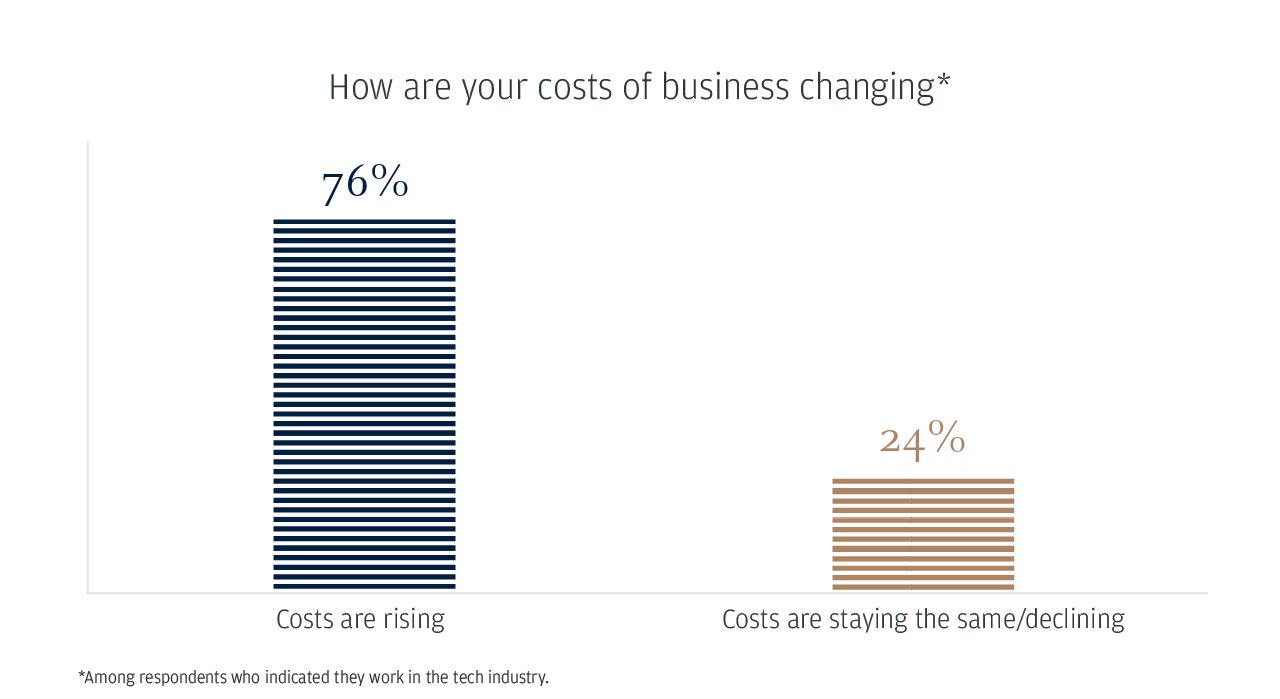

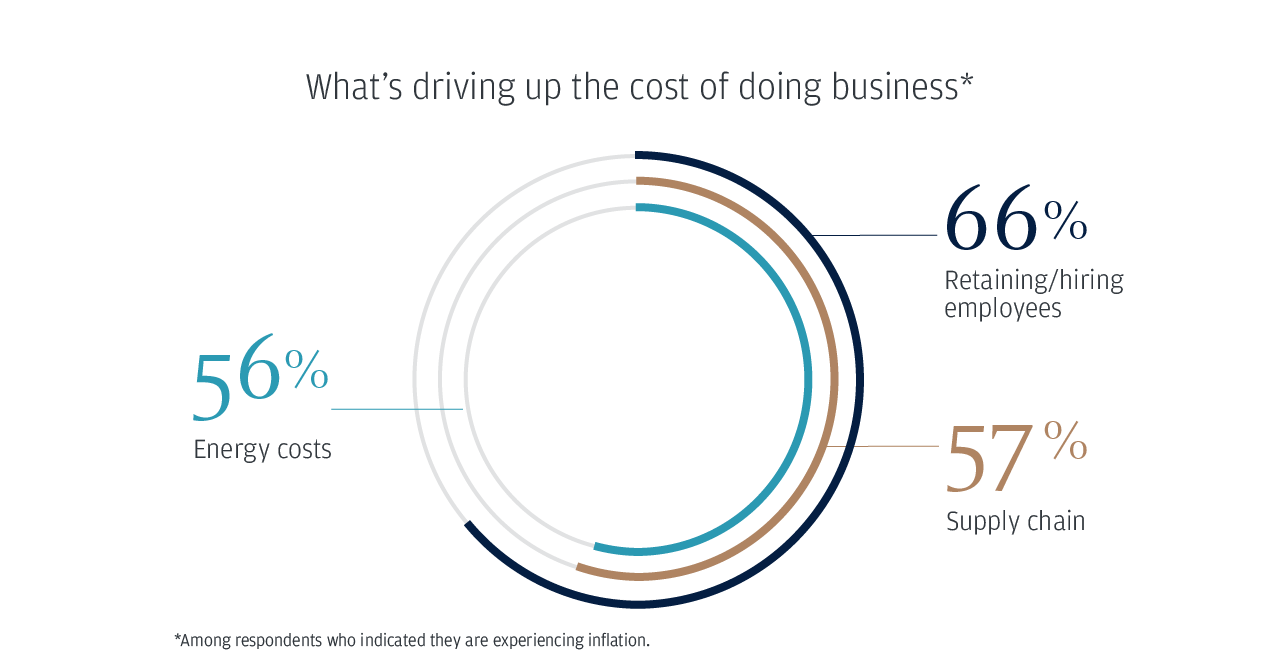

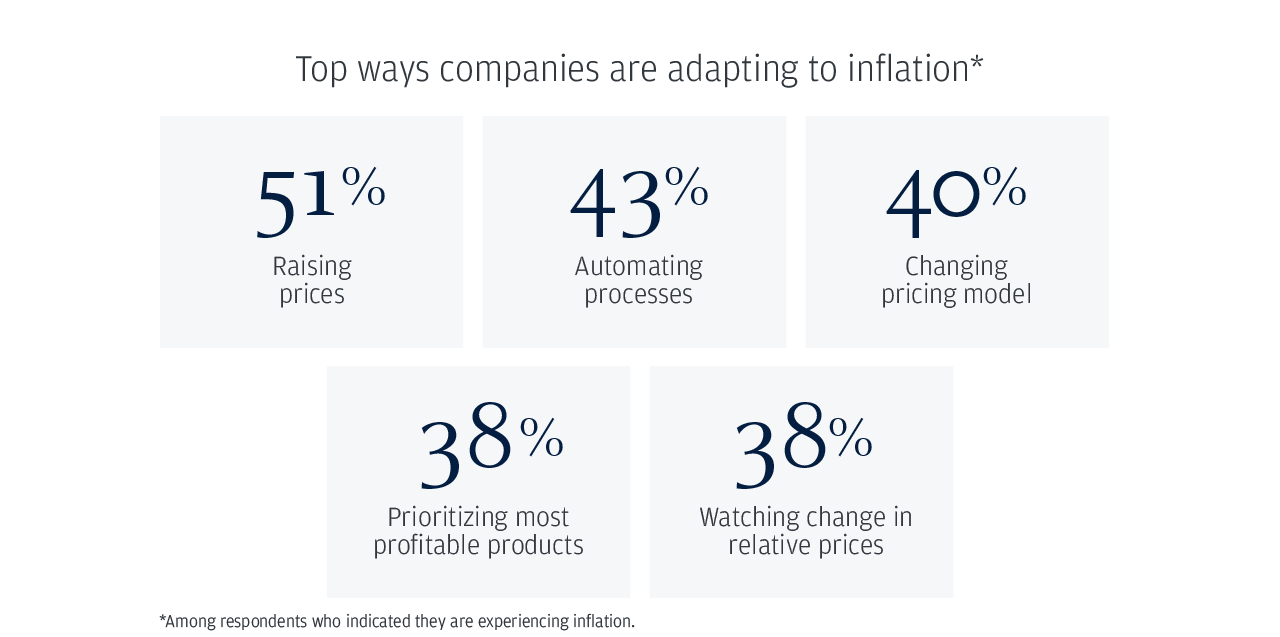

But leaders anticipate challenges ahead—55% expect a recession in 2023. Most respondents still are dealing with inflation (76%), and nearly half said their supply chain issues have gotten worse over the past 12 months. To mitigate these pressures, tech leaders are mainly focused on raising prices (51%) and automating more processes (43%).

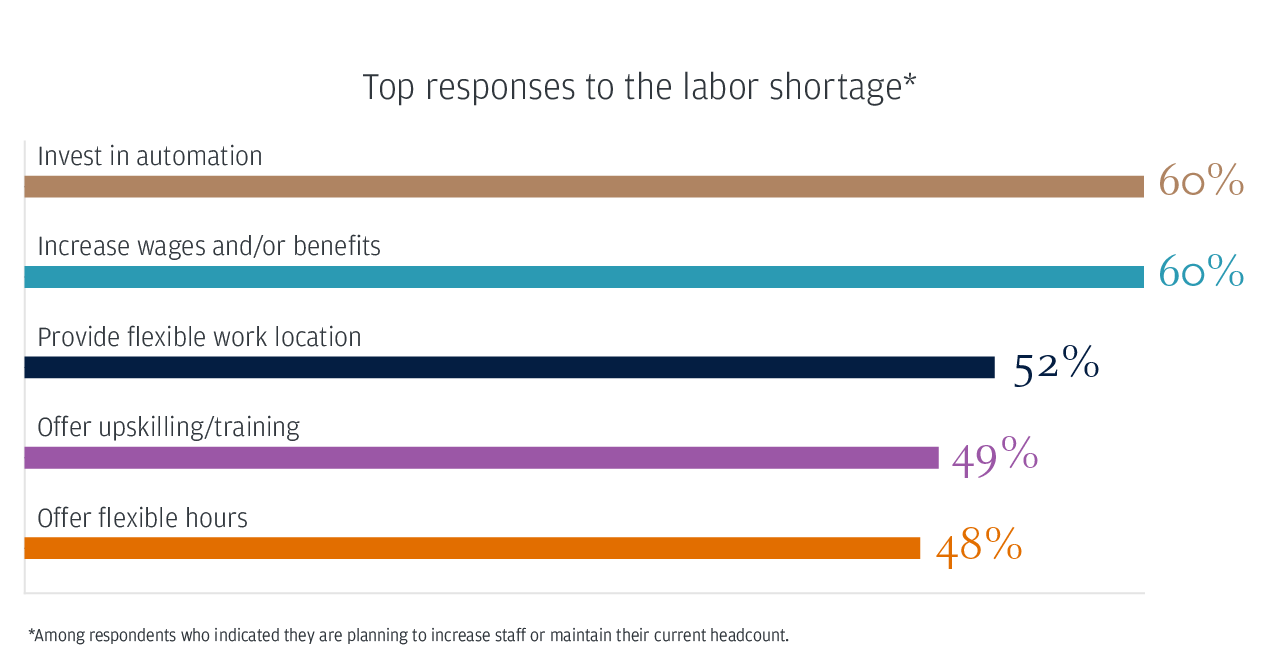

These challenges, however, may not hinder growth; 84% of leaders plan to add or keep employees this year. And roughly half are competing in the tight labor market by giving employees flexibility on where they work (52%) and when they work (48%).

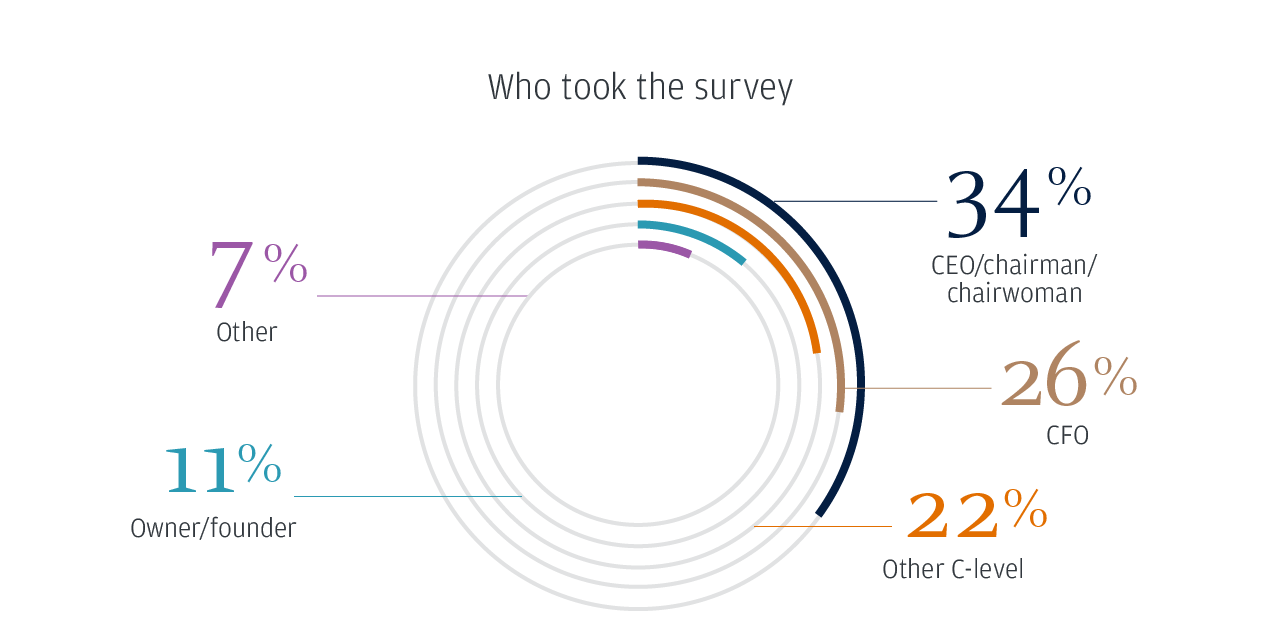

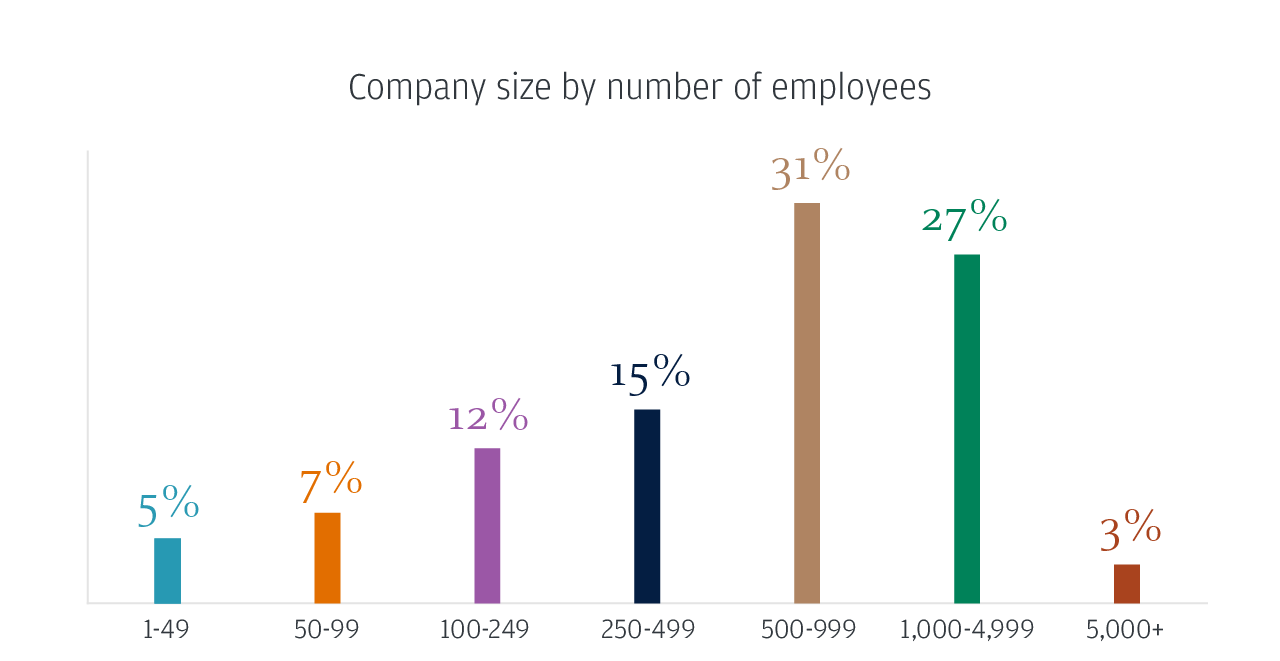

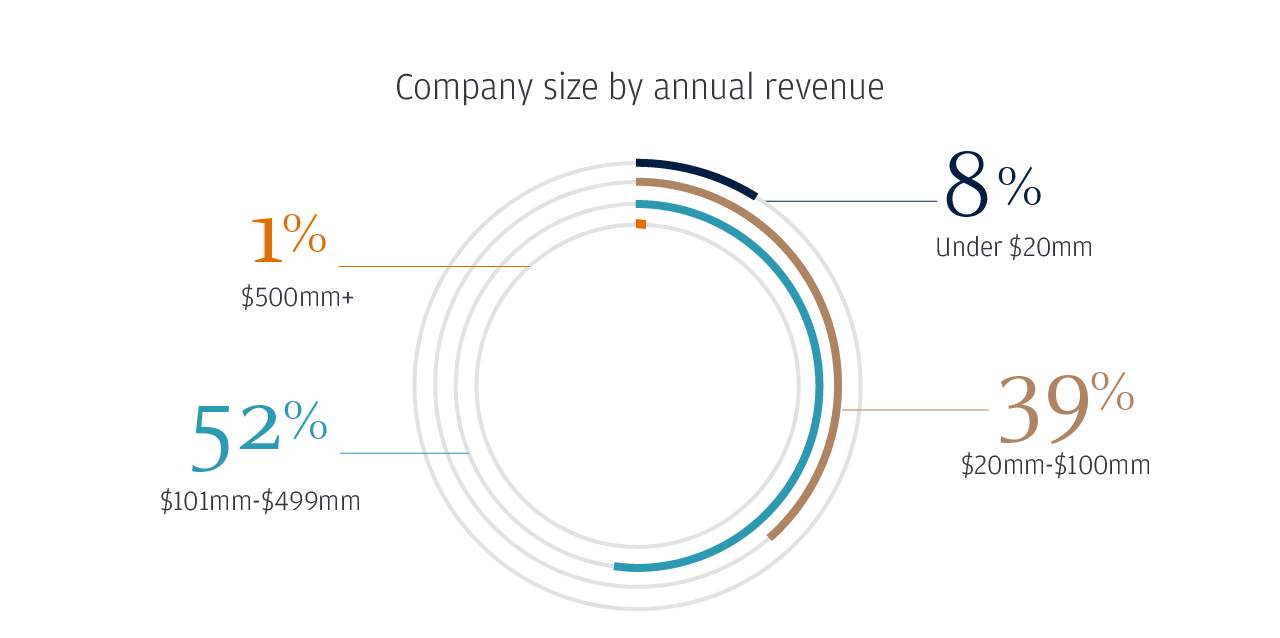

About the survey

Started in 2011, the annual and midyear Business Leaders Outlook survey series provides snapshots of the challenges and opportunities facing executives of midsize companies in the United States.

This year, 265 midsize tech industry respondents completed the online survey between Nov. 29 and Dec. 13, 2022. Results are within statistical parameters for validity; the error rate is plus or minus 6.0% at the 95% confidence interval.

Bullish on their own businesses

The vast majority of tech businesses (95%) expect their revenues to grow or hold steady. A slightly smaller percentage (90%) expect their capital expenditures to increase or remain the same.

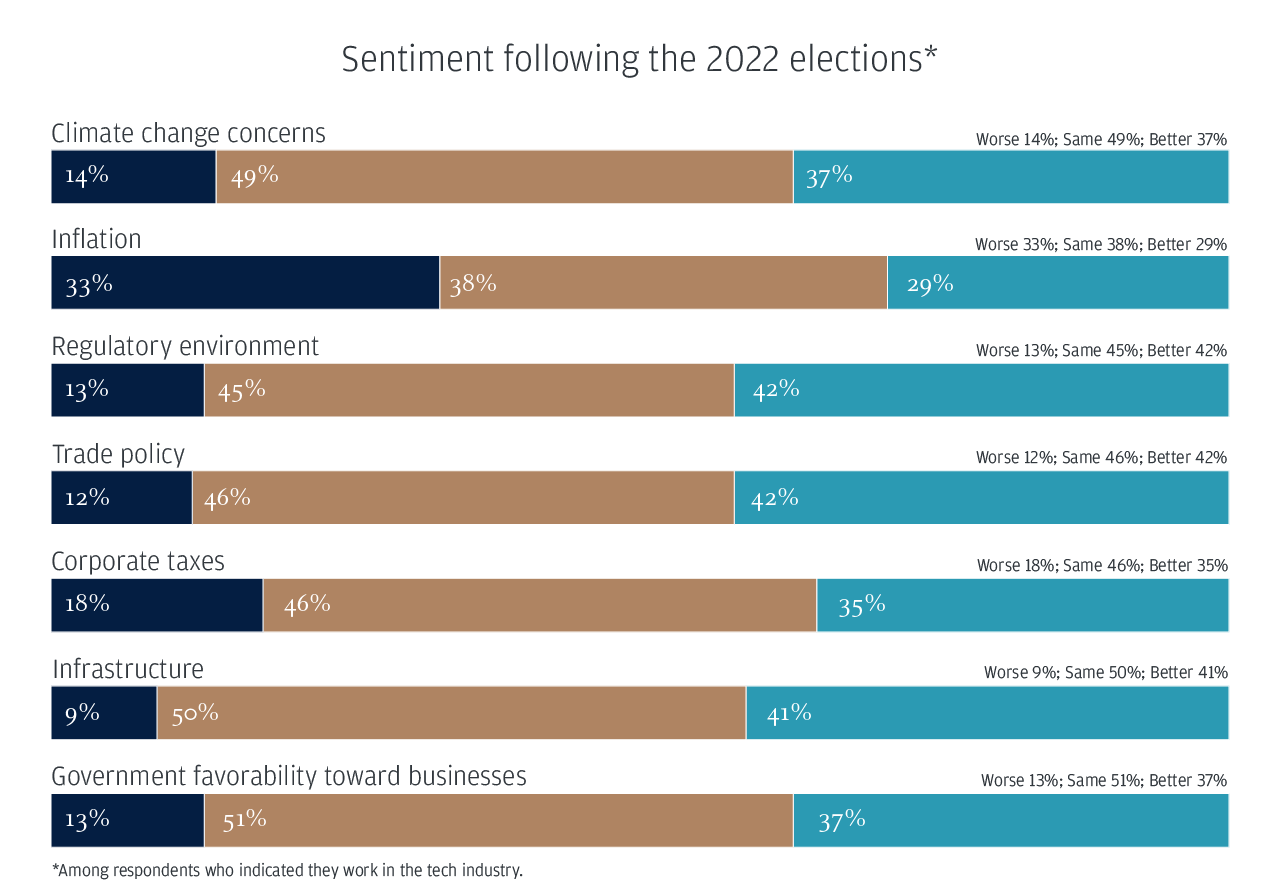

Election effects

Tech leaders generally don’t expect many changes due to recent elections.

Business challenges

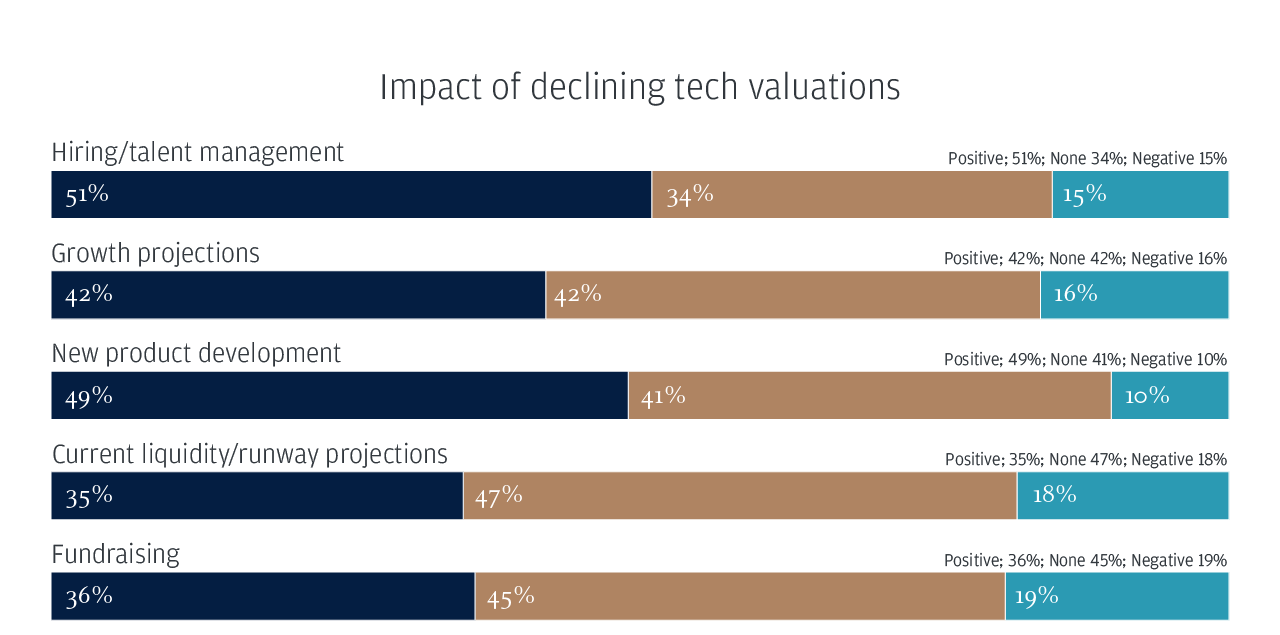

U.S. tech leaders face a number of challenges today, including persistent inflation, snarled supply chains, declining valuations and a competitive labor market.

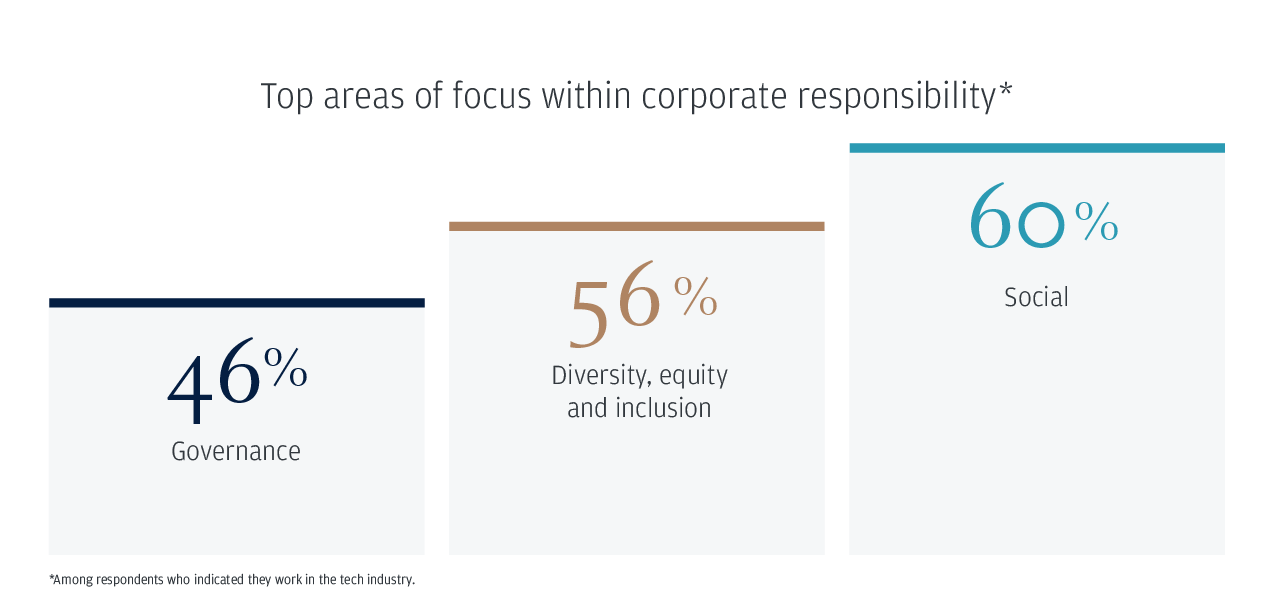

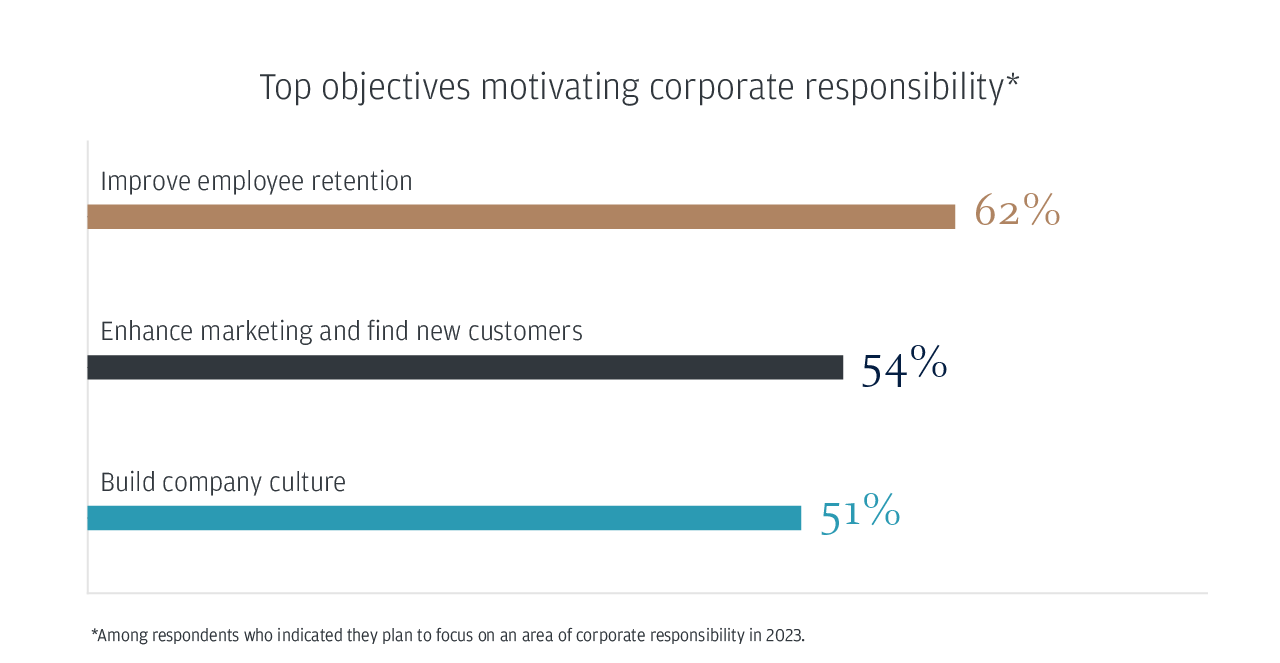

Social responsibility

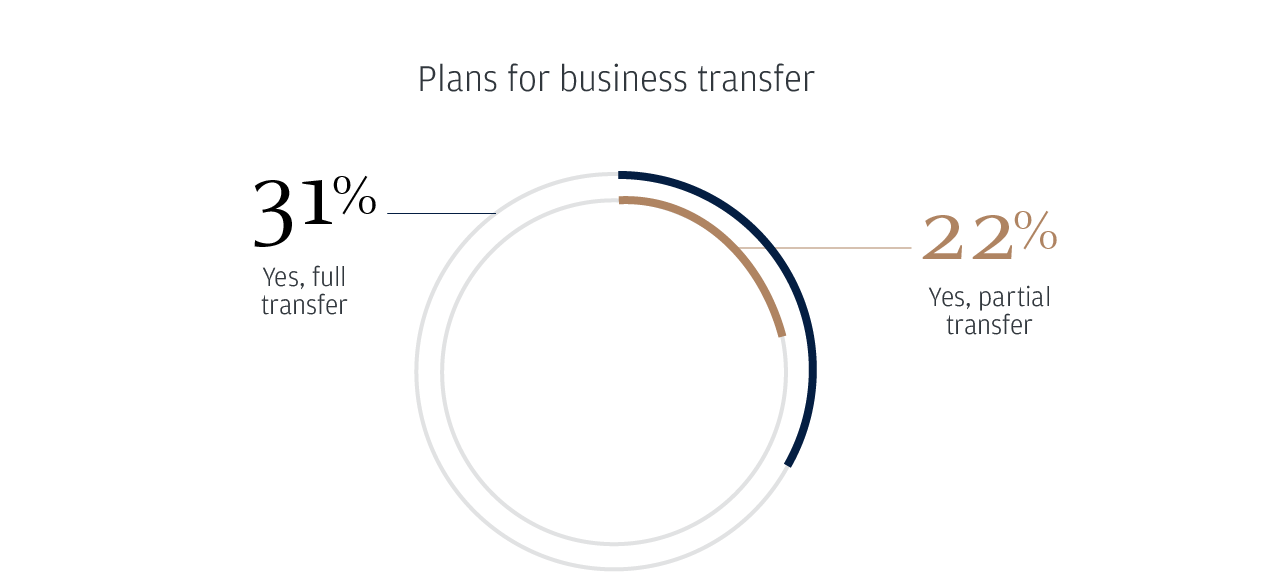

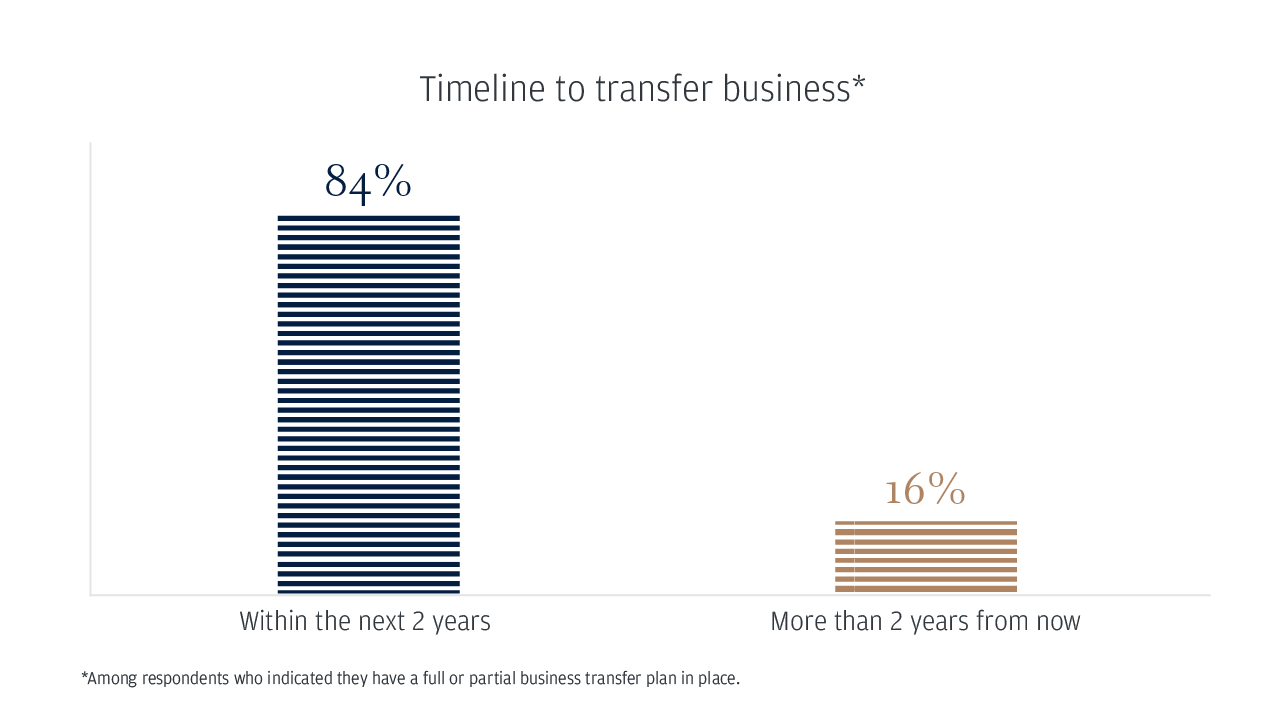

Business transitions and growth plans

Survey demographics

Note: Some numbers may not equal 100% due to rounding.

JPMorgan Chase Bank, N.A. Member FDIC. Visit jpmorgan.com/cb-disclaimer for disclosures and disclaimers related to this content.

Midyear survey

Hide

Midyear survey

Hide