About

Ashton Woods is a luxury homebuilding company making the dream of a personally customized home a reality for those looking to make an upgrade. For over 30 years, Ashton Woods has relied on honored design principles to build beautiful homes that are energy-efficient and meet families' ever-evolving needs. In 2017, Ashton Woods launched Starlight Homes to build homes with affordability and quality at the forefront. Starlight Homes embraces first-time homeowners for those who have felt homeownership was out of reach. To ensure maximum support for first-time homeowners, Starlight Homes gives customers access to home guides who are readily available to answer questions on the homebuying process and partner with customers from start to finish. Now, over 50,000 families across the country call an Ashton or Starlight home their own.

The challenge

The pandemic introduced payments challenges to businesses worldwide, and Ashton Woods was no exception. As demand increased for home builds, the company struggled to pay government entities with paper checks for permits and inspections, which threatened construction operations. The company also experienced supply-chain constraints that resulted in challenges equipping homes with standard appliances and other building materials.

Ashton Woods had an opportunity to improve these inefficiencies through reimagining how it measures, processes, and communicates transaction information. The company engaged J.P. Morgan to customize its existing commercial card program to better meet business demands.

The solution

Ashton Woods first advocated for migration of check payments for municipalities and government entities to One Card, which is a dual procurement and travel commercial card. One Card enabled online payments, decreased check processing fees and mailing time. It also reduced turnover time in obtaining permits and paying inspection fees to continue building homes.

Ashton Woods found efficiency in moving certain appliances and home fixture purchases to One Card. The company used a network of card-accepting suppliers to purchase major home appliances and other building materials, which helped with navigating a challenging environment in a digital payments world.

During the period of increased post-pandemic business, Ashton Woods worked closely with J.P. Morgan’s banking team to monitor credit usage and gradually increase the credit limit to meet business needs. “Proactive outreach to re-forecast credit needs was critical to program success," said Albert Jasani, Banking Relationship Lead, J.P. Morgan.

One Card comes with rewards or a rebate option, and with the rebate, clients earn a fixed percentage of the amount spent on business purchases. To add more value, J.P. Morgan proactively reached out to Ashton Woods and made contract revisions to help generate a higher rebate revenue on business purchases.

"Collaboration and communication were critical to the success of adopting the One Card program to thrive in a digital payments landscape."

Marissa Alfaro

Relationship Management Lead, J.P. Morgan

The results

By migrating traditional payments to One Card, Ashton Woods grew its business spending and rebate revenue year-over-year while enhancing business operations.

Business operations enhancements include:

- Enabling online payments for government entities not able to accept checks.

- Mitigating supply chain constraints by moving major appliance orders and other building suppliers to a digital payment.

Program rebate revenue growth:

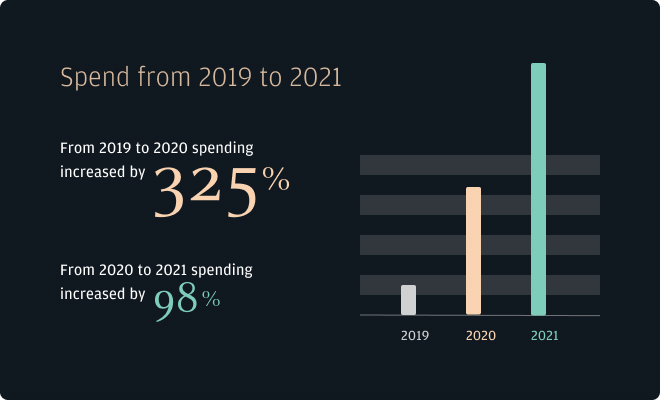

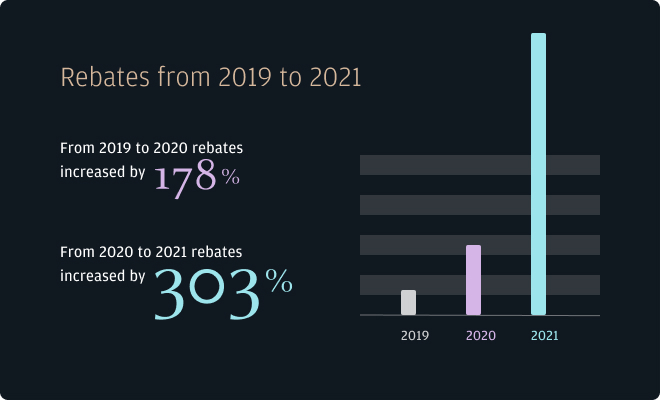

- From 2019 to 2020, spending and rebates increased by 325% and 178%, respectively.

- From 2020 to 2021, Ashton Woods experienced a 98% spending increase and a 303% growth in rebate with 28 open cards across the organization.

"While the rebate is certainly nice to have, the real benefit is that it's a good product that allows us to make payments in the method we need." —Zack Sawyer, Chief Accounting Officer at Ashton Woods

Ashton Woods plans to keep One Card top of mind for future supplier interactions and business purchases, as it allows the company to conduct business the way it needs. The One Card program by J.P. Morgan will continue fueling Ashton Wood's mission in a growing digital payments environment.

"We truly have a best-in-class relationship team whose only focus is to create opportunities for growth and to help our clients achieve their goals."

Niall Mackin

Head of Commercial Card Relationship Management, J.P. Morgan

2022 JPMorgan Chase & Co. Member FDIC. All rights reserved. The statements herein are confidential and proprietary and not intended to be legally binding. Not all products and services are available in all geographical areas. Visit jpmorgan.com/disclosures/payments for further disclosures and disclaimers related to this content.