Leaders forge ahead in 2026

Sentiment shifts from uncertainty to proactive planning

Sentiment shifts from uncertainty to proactive planning

January 07, 2026

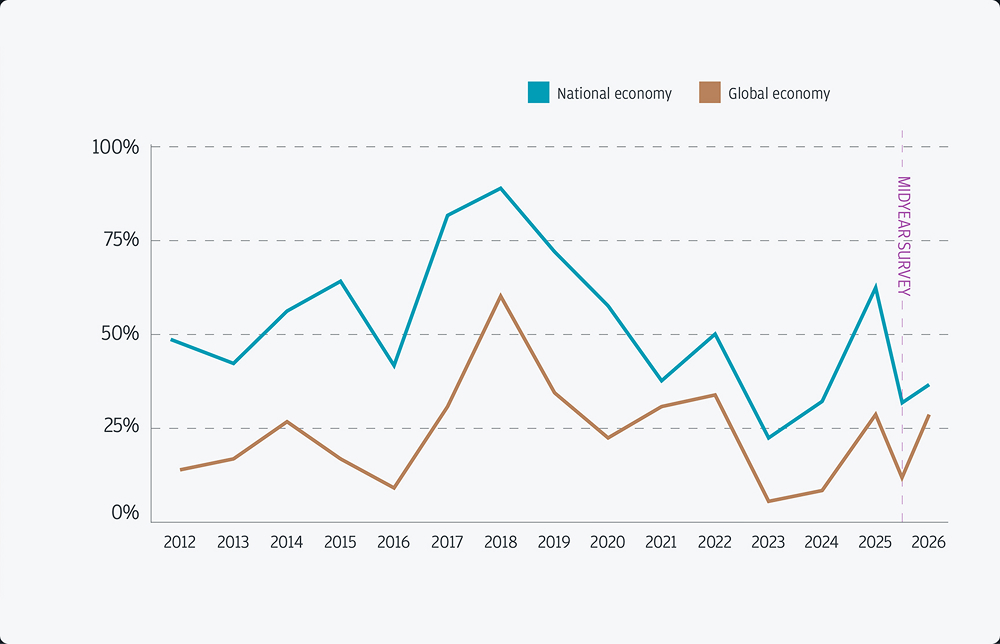

After a volatile year, business leaders’ view of the national economic outlook has stabilized, with a subdued 39% holding an optimistic view.

While down from a multi-year high of 65% a year ago, it represents a healthy recovery from the 2025 midyear survey. Executives’ confidence in their own company performance remains strong, with 71% reporting optimism for 2026.

Business leaders maintain a cautious global outlook, with most neutral or pessimistic (73%). Optimism for local economies has declined from 59% to 44% amid shifting policies and industry-specific challenges.

Midsize business owners continue to demonstrate resilience amid ongoing challenges and economic uncertainty. Roughly three-quarters (73%) expect to increase revenue in 2026, while 64% project higher profits. Nearly half (48%) still plan to expand their workforce, even as many incorporate AI into their operations.

AI is beginning to influence workforce planning, with 27% of leaders anticipating some headcount impact in 2026. The most common AI applications midsize businesses use or plan to use include process automation (62%), predictive analytics (44%) and market intelligence (42%).

Tariffs have had a significant effect this year: 61% of respondents report a negative impact on their costs, while 30% remain unaffected.

Respondents from Innovation Economy companies—early-stage startups and venture-backed and high-growth businesses—report higher optimism for their industry (66%) and company (82%) performance, but also have higher recession expectations—33% expect a recession or believe we’re already experiencing one.

“Despite mixed sentiment on the economic outlook, most business leaders remain confident about the year ahead for their own companies. Navigating macro uncertainty and managing through challenges has become the new normal. Midsize business leaders remain focused on driving sales and profit growth regardless of economic conditions.”

Ginger Chambless

Head of Market Insights, J.P. Morgan Commercial Banking

The annual Business Leaders Outlook survey, alongside historical data from the midyear 2025 Pulse survey in June and prior reports, shows that sentiment has fluctuated meaningfully over the past year. These shifts may reflect the impact of new tariffs and policy changes introduced in the last 12 months. Rate cuts and anticipated increased market stability have helped ease some of the uncertainty seen in June 2025.

National economic optimism has rebounded to 39%—up from its midyear low of 32%, but still 26 percentage points below the five-year high reached last year.

Global economic optimism has returned to nearly the same level (28%) as at the start of 2025. While still low, it aligns with the 15-year average of 26%.

National and global optimism

Recession expectations remain subdued. Half (51%) of business leaders don’t anticipate a recession in 2026.

About one-quarter (27%) of respondents expect a recession or believe we’re already experiencing one—down from 40% two years ago, but still higher than the 14% recorded at the beginning of 2025. Uncertainty has increased, with 22% unsure about a future recession, up from 16% at the start of 2025.

This more measured outlook may reflect the impact of 2025 rate cuts, which occurred in response to a cooling labor market. Looking ahead, Federal Reserve leadership changes and policy directions will likely continue to shape business sentiment throughout 2026.

Leaders remain optimistic about their own company performance, with 71% expressing confidence despite a more challenging economic environment.

In contrast, optimism about industry performance has declined 9 percentage points compared to a year ago.

This shift highlights how business leaders navigate uncertainty by focusing on areas where they have the greatest control and insight. Their ability to adapt and manage through volatility demonstrates a strategic approach to sustaining growth, even as broader industry sentiment softens.

Business expectations for revenue and profit growth remain steady, with 73% of leaders anticipating increased revenue and 64% expecting higher profits in 2026—nearly unchanged from last year.

Despite a turbulent environment, business leaders continue to demonstrate expertise in achieving positive margins and managing their businesses through shifting market conditions. This consistent optimism highlights their ability to adapt and deliver results, regardless of market conditions.

| Year | Revenue/sales | Profits |

|---|---|---|

| 2026 | 73% | 64% |

| 2025 | 74% | 65% |

While many challenges remain consistent year over year, 2026 brings notable shifts in what business leaders’ identify as their primary obstacles.

Uncertain economic conditions are the most frequently cited challenge this year compared to ranking third last year—49% of leaders identified them among their top concerns. Revenue and sales growth continues to rank second, cited by 33% of respondents.

Tariff-related issues are emerging as a pressing challenge at 31%, tying with workforce and labor concerns for third place.

49%

OF PARTICIPANTS

cited uncertain economic conditions as a top challenge

33%

OF PARTICIPANTS

cited revenue/sales growth as a top challenge

31%

OF PARTICIPANTS

cited labor or tariffs as a top challenge2

Over half of leaders (61%) report a moderate or significant negative impact. About one-third of respondents (30%) say tariffs have had no effect on their costs, while 9% report a moderate or significant positive impact.

Business leaders are prioritizing product innovation and profitability as growth strategies for 2026.

Over half (58%) plan to introduce new products or services, while 41% are focused on prioritizing their most profitable offerings.

Interest in strategic partnerships and investments rose, with 49% of leaders considering these approaches compared to 43% last year.

M&A appetite has also increased, with 39% of respondents citing mergers and acquisitions as a potential growth strategy—up 8 percentage points from last year. About half of respondents plan to grow their workforce in 2026, but planned reductions have also increased. This year, 12% of leaders plan to reduce headcount, compared to 8% last year.

“There’s a real sense of momentum among middle market business leaders as they prepare to set ambitious growth plans into motion. We’re seeing founders, leaders and investors pursuing strategic partnerships, exploring M&A and thinking creatively about how to position their companies for the future.”

Melissa Smith

Co-Head of J.P. Morgan Commercial Banking

Most businesses plan to implement AI in 2026, with the greatest focus on process automation (62%), predictive analytics (44%) and market intelligence (42%).

Only 11% of respondents don’t intend to use AI applications.

While 60% of midsize business leaders report that AI will have no impact on headcount in 2026, others anticipate adjustments as they integrate AI tools—ranging from efficiency gains that support growth to process changes that may affect staffing needs.

Top cited use cases for AI in 2026

This reflects the varied ways businesses are approaching AI adoption rather than uniform employment displacement. This marks the first year our survey has tracked AI’s workforce impact, reflecting how AI has moved from an emerging technology to an active business planning consideration.

| Process automation | Predictive analytics | Market intelligence | Chatbots | HR Processes |

|---|---|---|---|---|

| 62% | 44% | 42% | 31% | 29% |

Responses from leaders of Innovation Economy companies—early-stage startups and venture-backed and high-growth businesses—showed strong optimism in both company (82%) and industry (66%) performance.

Despite this optimism, recession expectations are higher in this segment, with 33% anticipating a recession or believing one is already underway, compared to 25% of U.S. middle market respondents.

The challenges facing Innovation Economy businesses differ sharply from those of the broader middle market, reflecting the current funding environment and the unique pressures of scaling early-stage companies.

Access to capital or credit is the top concern for 40% of leaders in this segment, far outpacing the 7% seen among midsize businesses—consistent with the tighter venture funding landscape where seed-to-Series-A advancement has become more challenging.

Government policy changes are also a greater worry, cited by 36% versus 20% in the middle market, as regulatory uncertainty around emerging technologies creates additional complexity for companies navigating rapid growth.

In contrast, labor and tariff concerns are less pronounced. Only 12% and 18% of Innovation Economy companies named labor and tariffs as top challenges, compared to 36% and 35% in the broader group.

AI implementation plans may drive different workforce decisions among startups, with 24% expecting their AI adoption to lead to increased headcount in 2026—more than double the 10% reported by middle market business leaders.

| Challenge | Innovation Economy | Middle Market |

|---|---|---|

| Uncertain economic conditions | 1 | 1 |

| Availability of capital/credit | 2 | 13 |

| Government policy changes (other than tariffs) | 3 | 6 |

| Revenue/sales growth | 4 | 4 |

| Tariffs | 5 | 3 |

| Adoption of artificial intelligence (AI)/generative AI | 6 | 7 |

| Global unrest/geopolitical concerns | 7 | 11 |

| U.S. competition/competitive environment | 8 | 10 |

| Lack of consumer confidence | 9 | 5 |

| Labor | 10 | 2 |

| Elevated interest rates | 11 | 9 |

| Supply chain issues | 12 | 8 |

| Cybersecurity and fraud concerns | 13 | 12 |

| Not facing any challenges currently | 14 | 15 |

| Foreign exchange volatility | 15 | 14 |

AI implementation plans may drive different workforce decisions for startups, with 24% expecting their AI adoption to lead to increased headcount in 2026—more than double the 10% reported by middle market business leaders.

52%

of Innovation Economy respondents report tariffs having a negative impact on business costs, compared to 64% of middle market respondents

24%

of Innovation Economy respondents expect AI to increase headcount in 2026, compared to 10% of middle market respondents

76%

of Innovation Economy respondents are planning strategic partnerships/investments in 2026, compared to 41% of middle market respondents

“The Innovation Economy data reinforces what we often see: Companies need distinctive strategic support. A venture-backed startup worried about Series A funding has different needs from an established manufacturer dealing with tariff impacts. Having advisors who understand specific industry challenges and growth patterns can help clients navigate their unique situation.”

John China

Co-Head of Innovation Economy, J.P. Morgan Commercial Banking

For 15 years, the annual and midyear Business Leaders Outlook survey series has provided snapshots of the challenges and opportunities facing executives of midsize companies.

This year, 1,469 respondents completed the online survey between Nov. 4 and Nov. 25, 2025. Results are within statistical parameters for validity; the margin of error is +/- 2.5 percentage points at the 95% confidence interval.

Since 2011, the J.P. Morgan Business Leaders Outlook survey has captured the perspectives of executives at midsize companies. Review our latest report for insights on how business leaders are preparing for the upcoming year.