Over the long term, through diverse market conditions, an allocation to alternative investments can help improve the risk and return versus a traditional portfolio of stocks and bonds.

J.P. Morgan Wealth Advisors

Alternative Investments Strategies

Your J.P. Morgan Wealth Advisor can provide access to a carefully curated set of high-conviction alternative investment strategies that can complement your traditional investment approach.

Alternative investments can be challenging, requiring an in-depth understanding to gauge the risks and identify potential opportunities, making them more suitable for sophisticated and experienced investors.

The primary roles alternatives play in a portfolio

With the markets delivering modest returns, alternative investments may serve as alternate sources to potentially generate above market returns for your portfolio.

Not all U.S. companies are public. Alternative investment strategies can help you expand the opportunity set of your portfolio by offering you the ability to invest in a broader set of firms.

J.P. Morgan undertakes a robust fund due diligence and manager selection process to identify strategies that can help you enhance your portfolio. We offer exclusive opportunities and attractive investment minimums, giving you more opportunities to invest towards your goals using alternative investments.

Access to J.P. Morgan's alternative investment strategies

Our reputation attracts both major industry players and newer, smaller alternative investment managers. We have long standing relationships with financial sponsors and private funds worldwide, allowing us to offer opportunities attractive investment minimums.

Private Equity

Expand your opportunity set and potentially enhance returns with investments in companies that are not publicly listed.

Private Credit

Generate income and seek out potentially higher yields with loans and bonds issued as private offerings, directly to the borrower.

Real Assets

Diversify sources of return and potentially hedge against inflation with investments in physical properties and infrastructure around the globe.

Hedge Funds

Tap into a wide range of strategies and securities that may offer potential for uncorrelated return streams and improved risk-adjusted returns.

Adding alternatives to your portfolio

The appropriate amount to allocate will depend on several factors, including your investment objectives, the size of any existing allocation to alternatives, your time horizon, and your tolerance for the lower liquidity of alternatives relative to traditional assets.

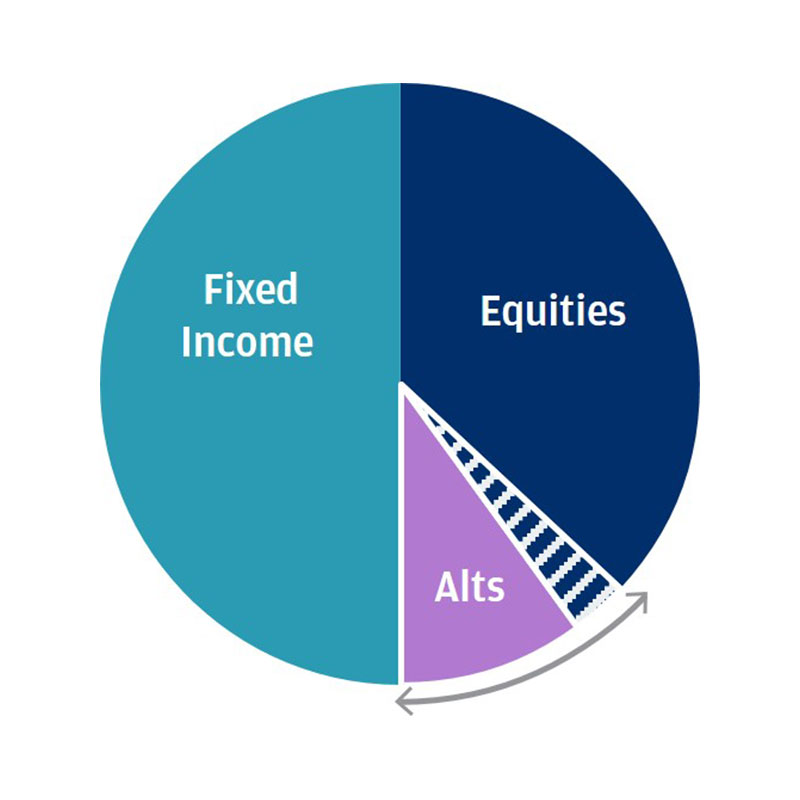

Reducing Volatility

Chart shows alternatives allocation expanding and equities allocation reducing to possibly help reduce volatility.

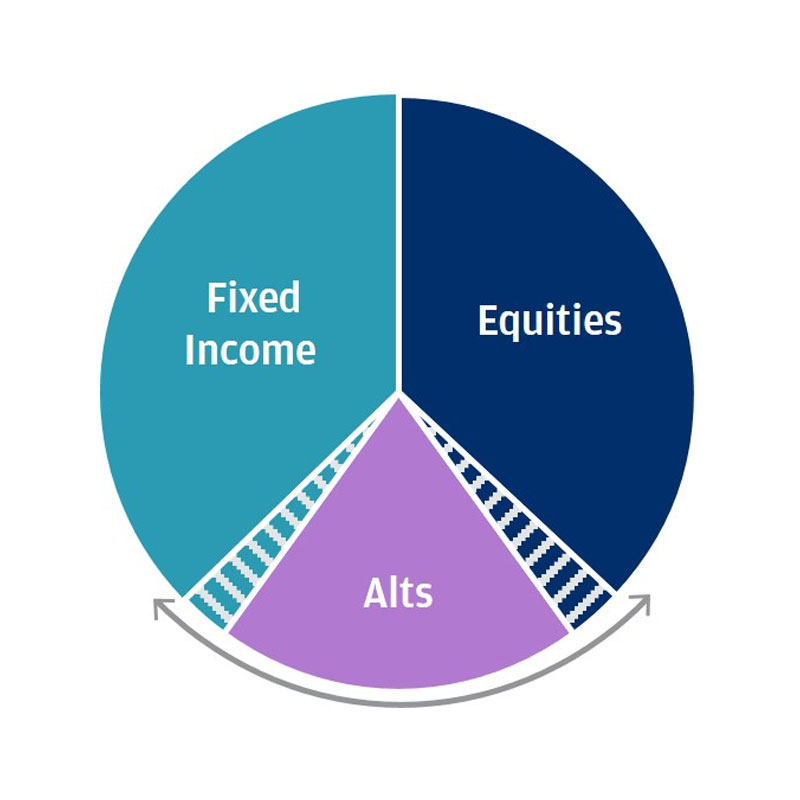

Enhancing Overall Returns

Chart shows alternatives allocation expanding while fixed income and equities allocation is reduced to possibly help enhance portfolio returns.

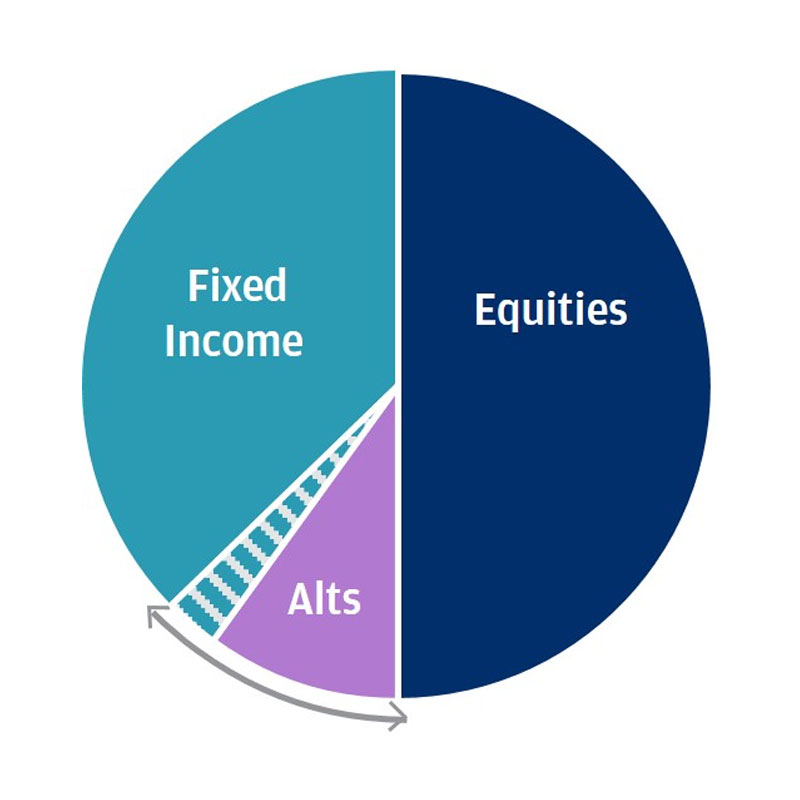

Increasing Portfolio Yield

Chart shows alternatives allocation expanding and fixed income allocation reducing to possibly help increase portfolio yield.

An experienced global team

J.P. Morgan harnesses the knowledge and experience of our global team to carefully curate a set of high conviction investment strategies designed to help you reach your goals.

Alternative investments are a core part of our clients portfolios and a key focus of the firm. Our deep history in the alternative investment space has helped us also build a unique network of relationships. These relationships offer us the unique ability to develop informed leads and first-look access to new opportunities. The result is sourcing investments that give our clients opportunities that may be unavailable at other firms.

Meet the team

Kristin Kallergis Rowland

Global Head of Alternative Investments

Sean Flynn

Head of Alternatives for Wealth Management

Investing

What to consider when you’re considering alternative investments

Mar 20, 2025

Prioritizing due diligence and manager selection can be key to building an allocation to alternatives that enhances your portfolio’s diversification and outperformance potential.

Read moreFrequently Asked Questions

Alternative investments, or commonly referred as alternative assets, is an investment in either a tangible or financial asset primarily within private markets, excluding traditional investments such as stocks, bonds and cash.

They are generally comprised of private equity, real assets, private credit, and hedge funds. They are commonly known as active, return-seeking strategies that have varied risk profiles and differs from traditional long-only investments.

Alternative investments can help you grow your wealth, diversify your portfolio and potentially uncover non-traditional returns in a low yield market. The “traditional” mix of stocks and bonds may no longer provide the returns investors need to reach their goals, causing alternative investments to go from optional to potentially essential portfolio building blocks. Depending on your goals, your J.P. Morgan Wealth Advisor can help you get started with alternative investing.

References

There can be no assurance that any or all of the members of the Alternative Investments Group will remain with the firm or that past performance or success of any such professional serves as an indicator of the Fund s success. Members of certain teams noted above provide services to multiple teams, including the Alternative Investments group. The organizational construct above is for illustrative purposes and is subject to change. Organization depicted is as of November 2023.

Based upon assets under supervision as of October 2023. Includes non-discretionary investments administered by J.P. Morgan Private Investments Inc.

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments involve greater risks than traditional investments and should not be deemed a complete investment program. They are not tax efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain. The value of the investment may fall as well as rise and investors may get back less than they invested.

Borrowing with securities as collateral involves certain risks, including the possibility that you may need to deposit additional securities and/or cash in the account to meet a maintenance call, and that securities in the account may be sold to meet the maintenance call. Proper management of your account and a thorough understanding of the conditions that may affect your investments will assist you in effectively using the margin lending program.

LEARN MORE ABOUT OUR FIRM AND INVESTMENT PROFESSIONALS AT FINRA BROKERCHECK.

To learn more about J.P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS (PDF) and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website provides information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (JPMS). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA, and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Please read additional Important Information in conjunction with these pages.