Contributors

Federico Cuevas

Global Investment Strategist

Global Investment Strategist

We put the odds of the U.S. staying in expansion mode in 2026 at 80% – including a 20% chance that the economy exceeds expectations and leads to a reacceleration of inflation. That’s not a “nothing can go wrong” call; it’s a strong vote of confidence in the resilience of the underlying economic environment.

That matters because 2025 gave investors plenty of reasons to doubt the outlook. Tariffs, immigration and policy noise fueled volatility and forced many economists to trim growth forecasts. Yet the economy kept moving – in Q3 2025, real gross domestic product (GDP) grew at a 4.3% annualized rate, far exceeding the initial expectation of roughly 3.3%. Our view is that this resilience extends into 2026.

The reason we’re comfortable leaning that way is that the key macro constraint is loosening, and it starts with inflation and the Federal Reserve (Fed). We anticipate inflation to remain rangebound (still above target, but not broadening to the stickier components), which should allow the Fed to maintain an easing bias. In fact, we’re anticipating one additional rate cut this year – not a signal of aggressive easing, but a move that keeps rates on a lower trajectory. That matters because it keeps financial conditions supportive.

With that backdrop, here are three reasons why we think growth will stay supported in 2026:

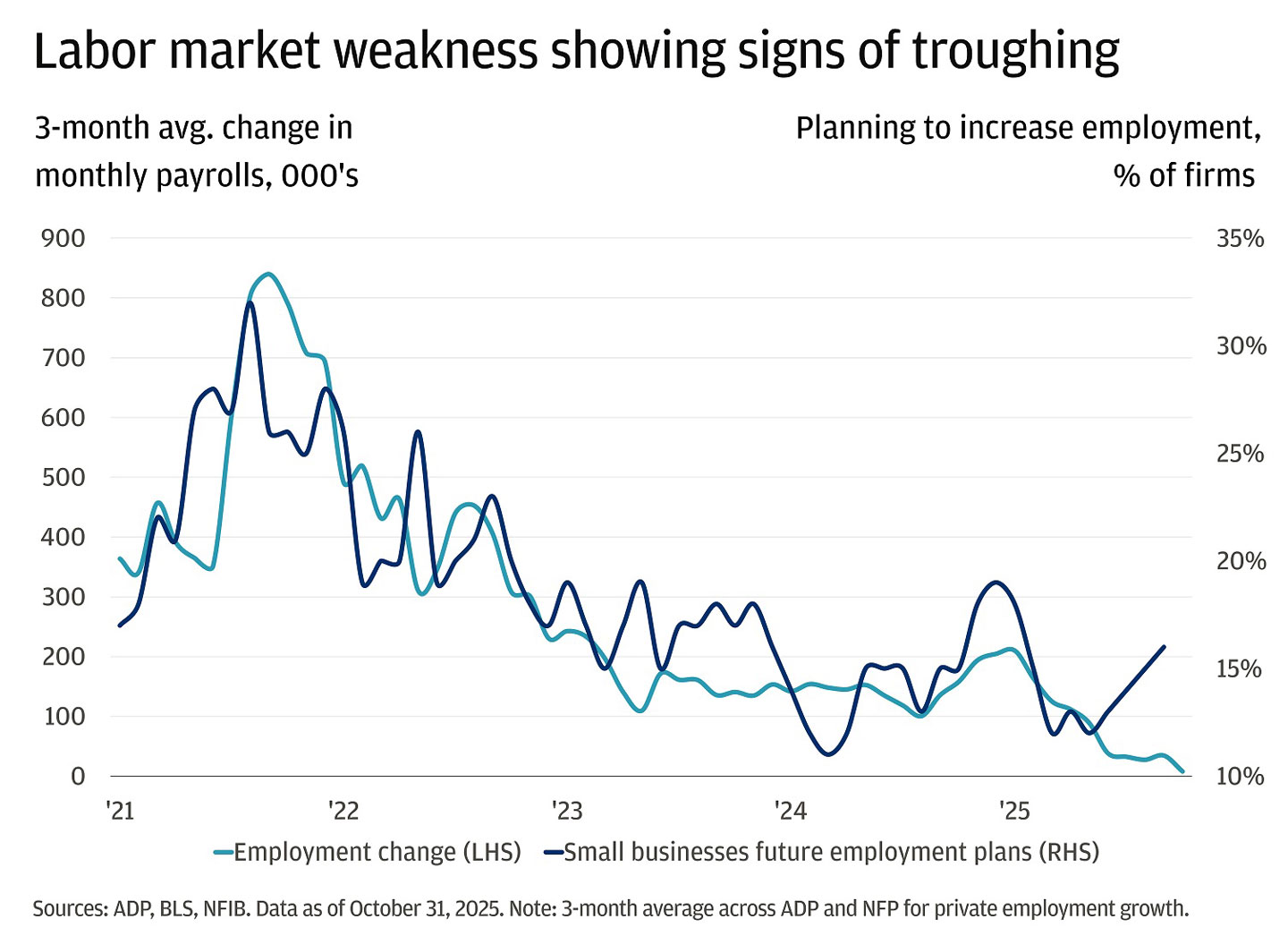

We expect the labor market to improve from here

Even though labor demand remains weak, further deterioration is unlikely because margins are near historic highs, talk of job cuts is limited and early signs of small-business hiring are emerging. Lower rates and steady real incomes should help stabilize conditions. The labor market doesn’t need to get red-hot; it just needs to stop sliding. We believe it will.

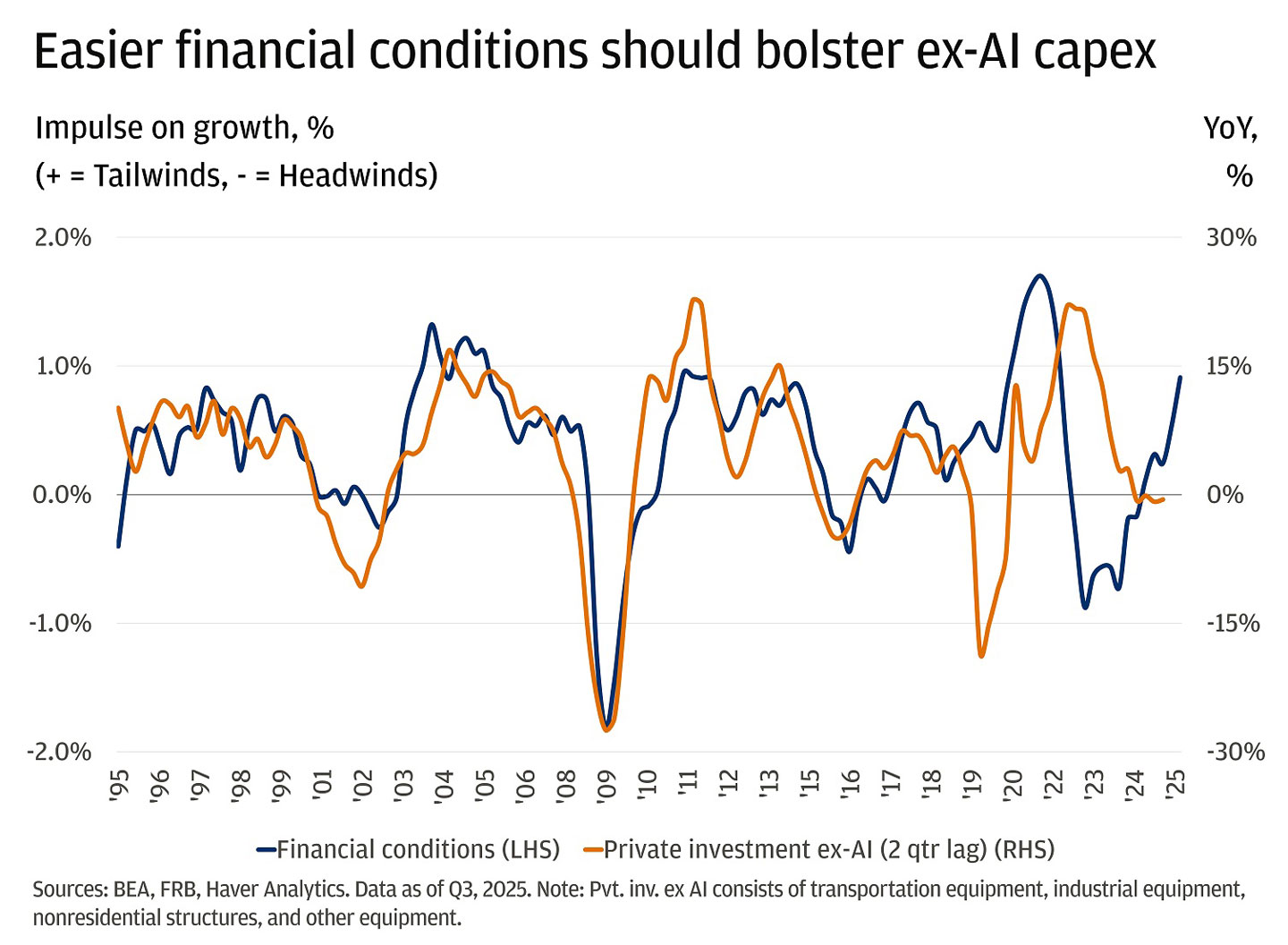

Capital expenditure keeps the cycle moving (artificial intelligence is the headline, but not the whole story)

The investment impulse looks durable, and easier financial conditions help extend the runway. Artificial intelligence (AI) capital expenditure (capex) is a meaningful driver, but capital expenditures beyond AI – from transportation equipment and industrial machinery to nonresidential structures – are expected to expand in tandem with easier financial conditions.

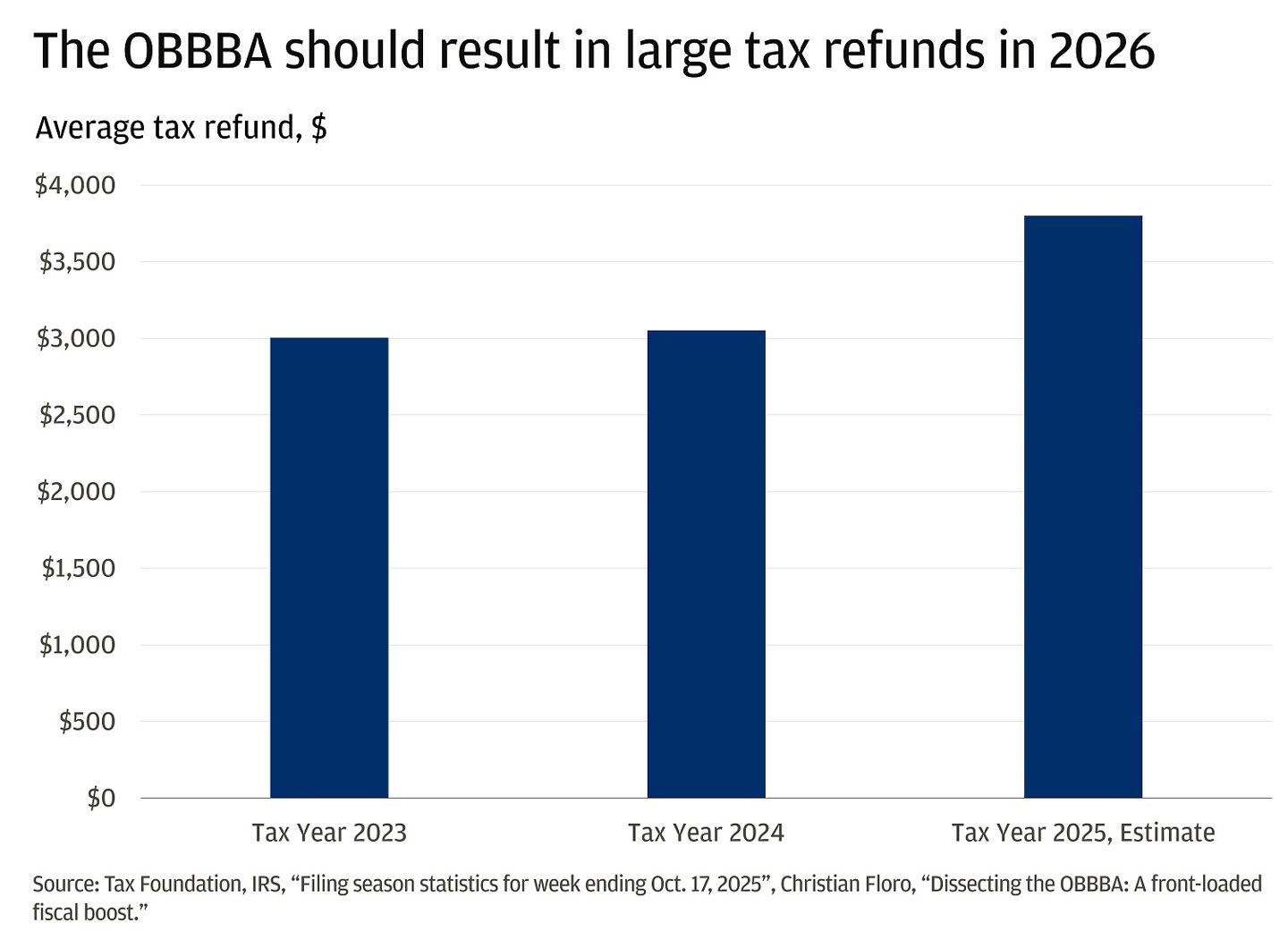

The One Big Beautiful Bill Act (OBBBA) adds a policy tailwind

It is a potent pro-growth surge delivering fiscal support and targeted incentives. Rising tax refunds early in the year should buoy consumer spending and spur business investment. We estimate that consumers will receive an extra $50 billion–$100 billion, about 0.2%–0.4% of annual disposable income.

The bottom line

Put it together, and we’re comfortable underwriting 2% growth in 2026, a similar level to the 2% growth expected for 2025.

This setup is very much in line with how we’re framing 2026 in our broader Outlook: Promise and Pressure. We see breakthrough AI innovation, a shifting global landscape and a recalibrated inflation regime create an environment of significant opportunity tempered by enduring structural challenges.

Of course, there are risks. The Venezuela headlines this past weekend were upbeat for the future prospects of the country (check out our latest webinar replay here), yet they still served as a real-time reminder of how quickly the narrative can shift. There is also the risk that inflation proves sticky or reaccelerates. The Fed could be forced to pause rate cuts – or even revisit rate hikes – catching markets off guard after they had been anticipating a lower inflation and rate environment. Geopolitics and inflation are just one source of uncertainty, but far from the only one. In our 2026 Outlook, we address the big questions we’re hearing most from investors about AI, a fragmented world and inflation.

Building on that discussion, our Chairman of Market and Investment Strategy, Michael Cembalest, in his 2026 Eye on the Market Outlook, covers a range of topics. Notably, he highlights four key risks shaping today’s environment: a metaverse moment for the hyperscalers, U.S. power generation constraints, China expanding its competitive edge in AI and the paradox of U.S. reliance on Taiwan – a crucial semiconductor hub that is de¬eply tied to China.

All that to say, stay constructive but mindful. Our base case keeps us leaning pro-growth, while our risk analysis guides us on where to size carefully, what to diversify with and what we want to own if the path gets bumpier. Here are the areas we have highest conviction on:

- We’re targeting an S&P 500 year-end around 7,300 in our base case – with a bull case closer to 8,100 if the market keeps rewarding durable growth.

- We expect investment grade (IG) bond spreads to hold around 85 basis points (bps). More a steady, reliable carry than a wild home run, but nonetheless a vital ballast in a diversified portfolio. In an era of rangebound inflation and an easing Fed, bonds can finally shine again.

- We’re anticipating that gold will finish above 5,250. Gold is a robust hedge against sticky inflation, geopolitical headwinds and unexpected policy moves. Think even broader when diversifying your diversifiers.

All market and economic data as of 01/09/2026 are sourced from Bloomberg Finance L.P. and FactSet unless otherwise stated.

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

DISCLOSURES

Index definitions:

Standard and Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index was developed with a base level of 10 for the 1941–43 base period.

The Bloomberg Eco Surprise Index shows the degree to which economic analysts under- or over-estimate the trends in the business cycle. The surprise element is defined as the percentage difference between analyst forecasts and the published value of economic data releases.

The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance.

The NASDAQ 100 Index is a basket of the 100 largest, most actively traded U.S companies listed on the NASDAQ stock exchange. The index includes companies from various industries except for the financial industry, like commercial and investment banks. These non-financial sectors include retail, biotechnology, industrial, technology, health care, and others.

The Russell 2000 Index measures small company stock market performance. The index does not include fees or expenses.

We believe the information contained in this material to be reliable but do not warrant its accuracy or completeness. Opinions, estimates, and investment strategies and views expressed in this document constitute our judgment based on current market conditions and are subject to change without notice.

The views, opinions, estimates and strategies expressed herein constitutes the author's judgment based on current market conditions and are subject to change without notice, and may differ from those expressed by other areas of J.P. Morgan. This information in no way constitutes J.P. Morgan Research and should not be treated as such. You should carefully consider your needs and objectives before making any decisions. For additional guidance on how this information should be applied to your situation, you should consult your advisor.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

RISK CONSIDERATIONS

- Past performance is not indicative of future results. You may not invest directly in an index.

- The price of equity securities may rise or fall due to the changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. Equity securities are subject to 'stock market risk' meaning that stock prices in general may decline over short or extended periods of time.

- Investing in fixed income products is subject to certain risks, including interest rate, credit, inflation, call, prepayment and reinvestment risk. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss.

- In general, the bond market is volatile and bond prices rise when interest rates fall and vice versa. Longer term securities are more prone to price fluctuation than shorter term securities. Any fixed income security sold or redeemed prior to maturity may be subject to substantial gain or loss. Dependable income is subject to the credit risk of the issuer of the bond. If an issuer defaults no future income payments will be made.

- When investing in mutual funds or exchange-traded and index funds, please consider the investment objectives, risks, charges, and expenses associated with the funds before investing. You may obtain a fund’s prospectus by contacting your investment professional. The prospectus contains information, which should be carefully read before investing.

- Investors should understand the potential tax liabilities surrounding a municipal bond purchase. Certain municipal bonds are federally taxed if the holder is subject to alternative minimum tax. Capital gains, if any, are federally taxable. The investor should note that the income from tax-free municipal bond funds may be subject to state and local taxation and the alternative minimum tax (amt).

- International investments may not be suitable for all investors. International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the u.s. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in international markets can be more volatile.

- Investments in emerging markets may not be suitable for all investors. Emerging markets involve a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the u.s. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the united states and other nations. Investments in emerging markets can be more volatile.

- Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

- Real estate investments trusts may be subject to a high degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate investments may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower.

- Investment in alternative investment strategies is speculative, often involves a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by sophisticated investors with the financial capability to accept the loss of all or part of the assets devoted to such strategies.

- Structured products involve derivatives and risks that may not be suitable for all investors. The most common risks include, but are not limited to, risk of adverse or unanticipated market developments, issuer credit quality risk, risk of lack of uniform standard pricing, risk of adverse events involving any underlying reference obligations, risk of high volatility, risk of illiquidity/little to no secondary market, and conflicts of interest. Before investing in a structured product, investors should review the accompanying offering document, prospectus or prospectus supplement to understand the actual terms and key risks associated with the each individual structured product. Any payments on a structured product are subject to the credit risk of the issuer and/or guarantor. Investors may lose their entire investment, i.e., incur an unlimited loss. The risks listed above are not complete. For a more comprehensive list of the risks involved with this particular product, please speak to your J.P. Morgan team.

- As a reminder, hedge funds (or funds of hedge funds) often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. These investments can be highly illiquid, and are not required to provide periodic pricing or valuation information to investors, and may involve complex tax structures and delays in distributing important tax information. These investments are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum.

- For informational purposes only -- J.P. Morgan Securities LLC does not endorse, advise on, transmit, sell or transact in any type of virtual currency. Please note: J.P. Morgan Securities LLC does not intermediate, mine, transmit, custody, store, sell, exchange, control, administer, or issue any type of virtual currency, which includes any type of digital unit used as a medium of exchange or a form of digitally stored value.

- The prices and rates of return are indicative, as they may vary over time based on market conditions.

- Additional risk considerations exist for all strategies.

- The information provided herein is not intended as a recommendation of or an offer or solicitation to purchase or sell any investment product or service.

- Opinions expressed herein may differ from the opinions expressed by other areas of J.P. Morgan. This material should not be regarded as investment research or a J.P. Morgan investment research report.

Check the background of our firm and investment professionals on FINRA's BrokerCheck

To learn more about J. P. Morgan Wealth Management’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC ("JPMS"). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Please read additional Important Information in conjunction with these pages.