When family members harbor the belief that they are not being treated fairly – whether because they believe their hard work is going unnoticed or because they sense unequal treatment – it can create quiet resentment and simmering tension within the family.

Key takeaways

- Families often face challenges when discussing wealth, with 70% of family members saying they face difficulties approaching the topic. Differing perspectives and communication styles contribute to misunderstandings.

- Emotional factors such as stress, anxiety and fear of conflict can make conversations about family wealth difficult for all generations.

- Open and transparent communication is important for building trust and clarity within families, helping members understand roles and responsibilities.

- Striving for alignment on shared values and goals can strengthen family relationships and support successful wealth transitions across generations.

Contributors

Head of Wealth Partners & Family Wealth Services

Managing Director, Head of Family Engagement and Governance

Managing Director, Wealth Partners Strategy, New York Metro Area Regional Lead, Family Engagement and Governance

Executive Director, Family Engagement and Governance

Communication is vital to building and sustaining a family’s prosperity across generations. Yet many families struggle to discuss money – and some families don’t communicate at all.

The J.P. Morgan Family Wealth InstituteTM published research revealing that seven out of 10 family members face difficulties discussing wealth with each other. The study identified (PDF) challenges faced by generations and outlined steps that families can take to strengthen family communication.

Here are some of the main insights:

Insight 1: Family wealth is an elusive concept

Family members often have different views on wealth – and that is especially true across generations.

Jessica Douieb, Managing Director and Head of Wealth Partners and Family Wealth Services at J.P. Morgan Advisors, believes this study sheds light on these generational dynamics.

"Today’s families face new complexities, from changing technology to evolving family structures. We’re here to help you navigate these challenges with clarity and confidence, empowering every generation to participate, connect and thrive."

Jessica Douieb

Head of Wealth Partners, J.P. Morgan Advisors

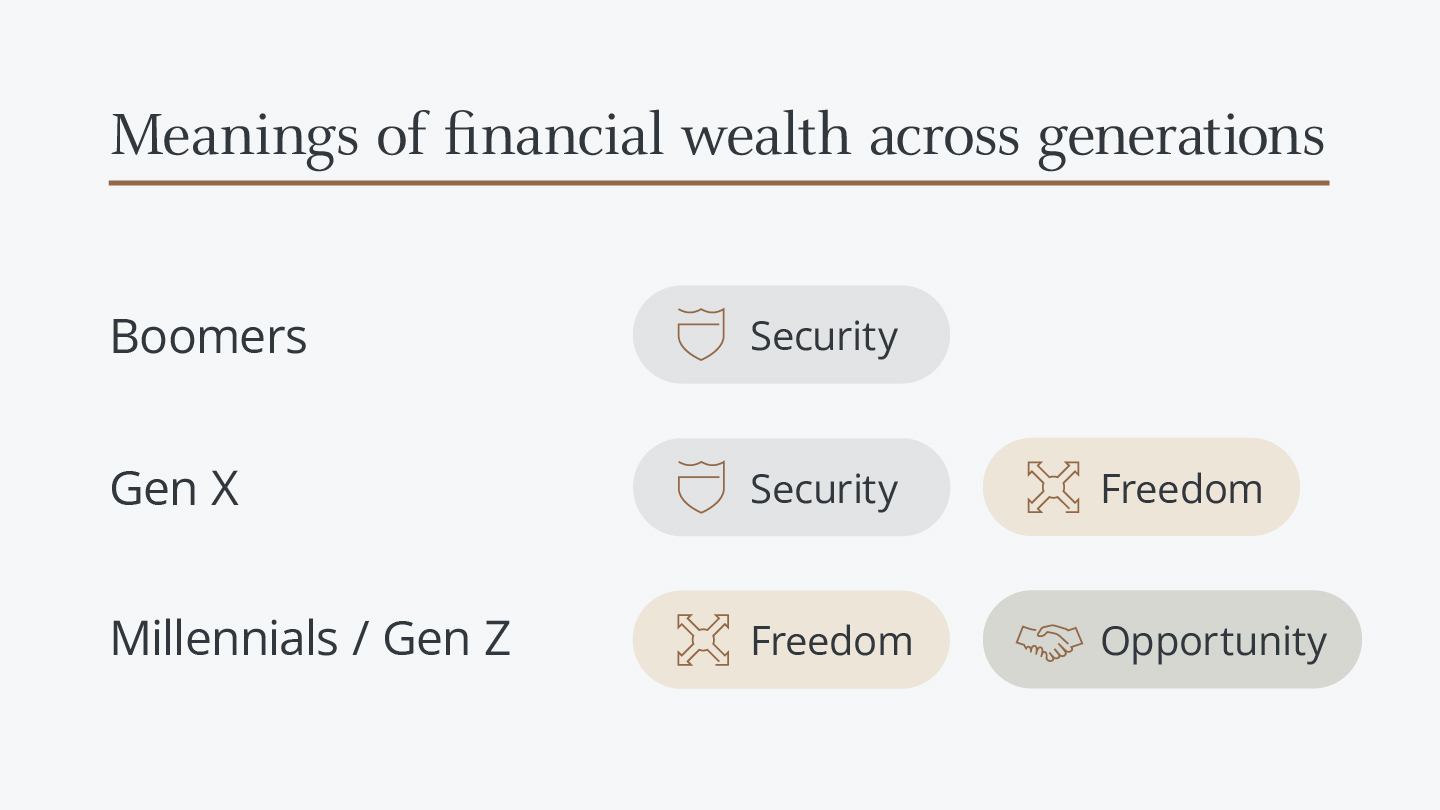

In conversations with families, J.P. Morgan found that older generations tend to associate wealth with security: It provides a shield against instability and should therefore be protected and preserved. Likewise, Gen Xers and boomers who are first-generation wealth holders reported feeling pressure to uphold the values that created the wealth and avoid any decisions that could diminish it.

Millennials and Gen Z family members, on the other hand, viewed family wealth as a source of freedom. This freedom offers flexibility in their career choices and allows them to travel and live their values. These younger generations are more likely to feel a duty to prove that they can uphold the wealth built by their parents and grandparents.

Communication styles across generations

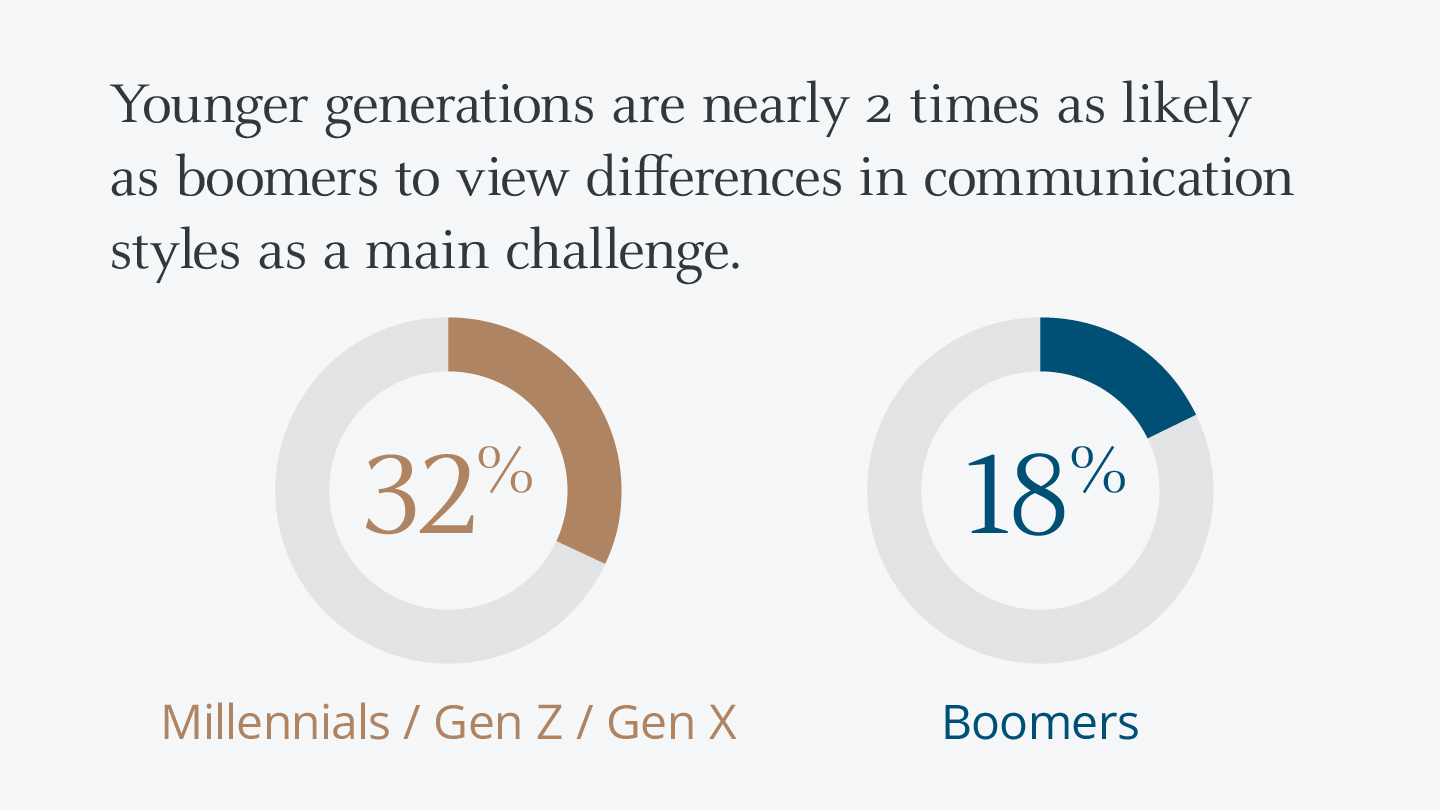

In addition to their differing ideas about wealth, family members can also have different communication styles, making it more difficult for them to find common ground. Where boomers prefer conventional styles like face-to-face conversations or phone calls, millennial and Gen Z family members are more likely to embrace casual or fluid styles, like evolving digital communication platforms. (Gen Xers, as the “sandwich generation,” tend to balance both approaches.)

It’s not just the mode of communication that differs: Older generations also favor one-on-one conversations, with some preferring to avoid tough topics to prevent conflict. Meanwhile, younger generations who value transparency and immediacy, want to have more open discussions.

As a result, 32% of Gen Xers, millennials, and Gen Zers viewed differences in communication styles as a main challenge.

Insight 2: Discussing family wealth can touch nerves

Another challenge to discussing wealth: It can be a difficult topic, rife with emotions such as pride, worry, responsibility and uncertainty.

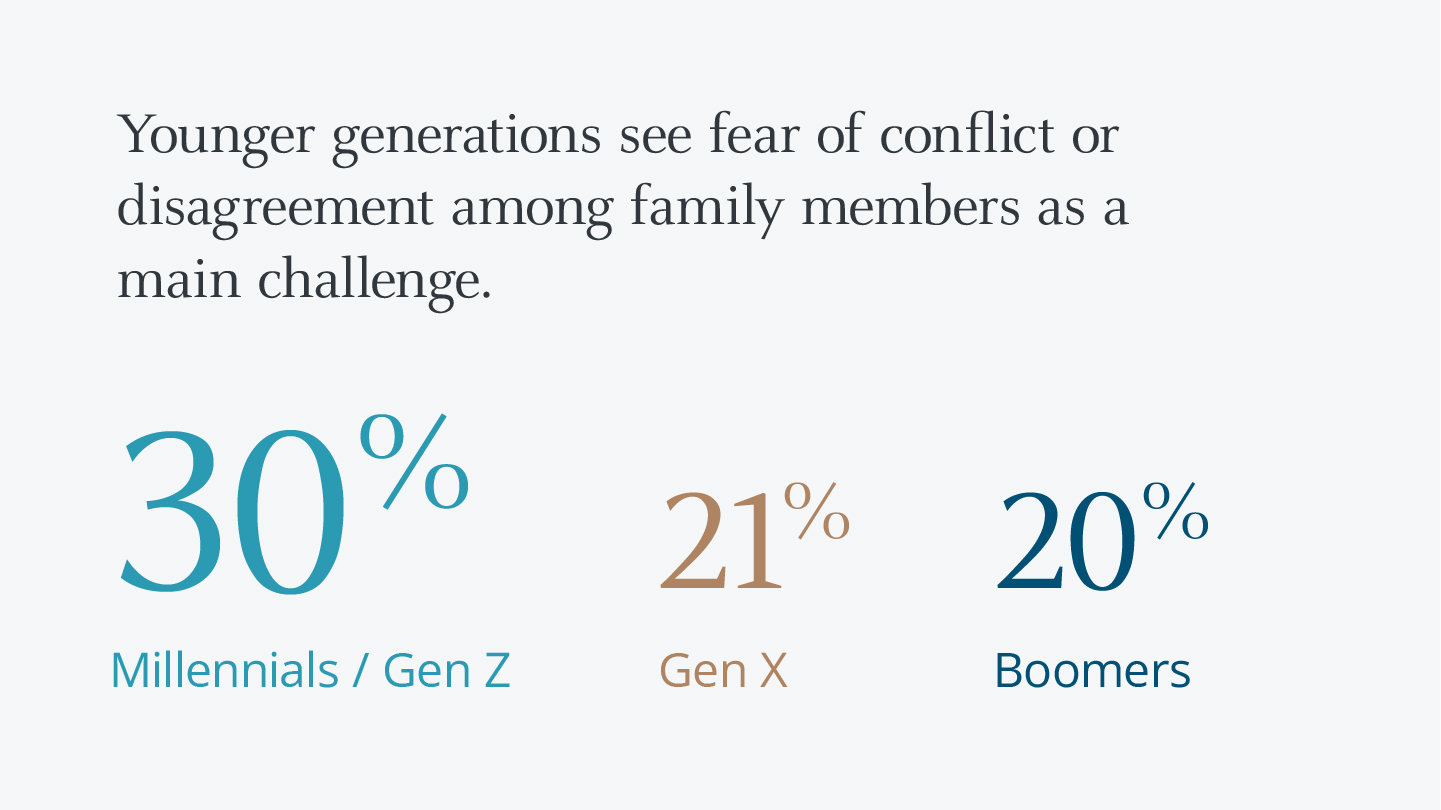

According to J.P. Morgan’s research, nearly one-in-three millennial and Gen Z family members cite a fear of conflict or disagreement among family members as a main challenge to discussing family wealth. Gen Xers, millennials and Gen Zers were nearly twice as likely to experience stress and anxiety during financial conversations compared to boomers.

Four common hurdles around communication

All generations admit to viewing emotional factors as a significant challenge to talking about wealth. Four common hurdles include:

Fear of conflict, entitlement or a general disruption of family harmony can result in a lack of transparency around family wealth. This can be frustrating for those left in the dark – usually the younger generations, nearly a quarter of whom report feeling uninformed.

Around 20% of family members report procrastination or avoidance of financial discussions, with many saying that they learned key information only after a crisis or other significant life event. This can exacerbate the unsettling emotions around family wealth.

Older generations often wait for their heirs to show signs of maturity or responsibility before sharing decision-making power. But those younger family members are craving mentorship. They want gradual exposure to financial decision-making and space to ask questions without fear of judgment.

Insight 3: Families crave connection and clarity

Family members want meaningful conversations, not just transactional ones.

For younger members, that means more involvement in multigenerational conversations, with 87% of millennials and Gen Zers valuing the discussion of family wealth and financial matters. On the flip side, one-in-three boomers think these discussions are not very important – a gap that could turn into a source of conflict if either generation is unwilling to adapt.

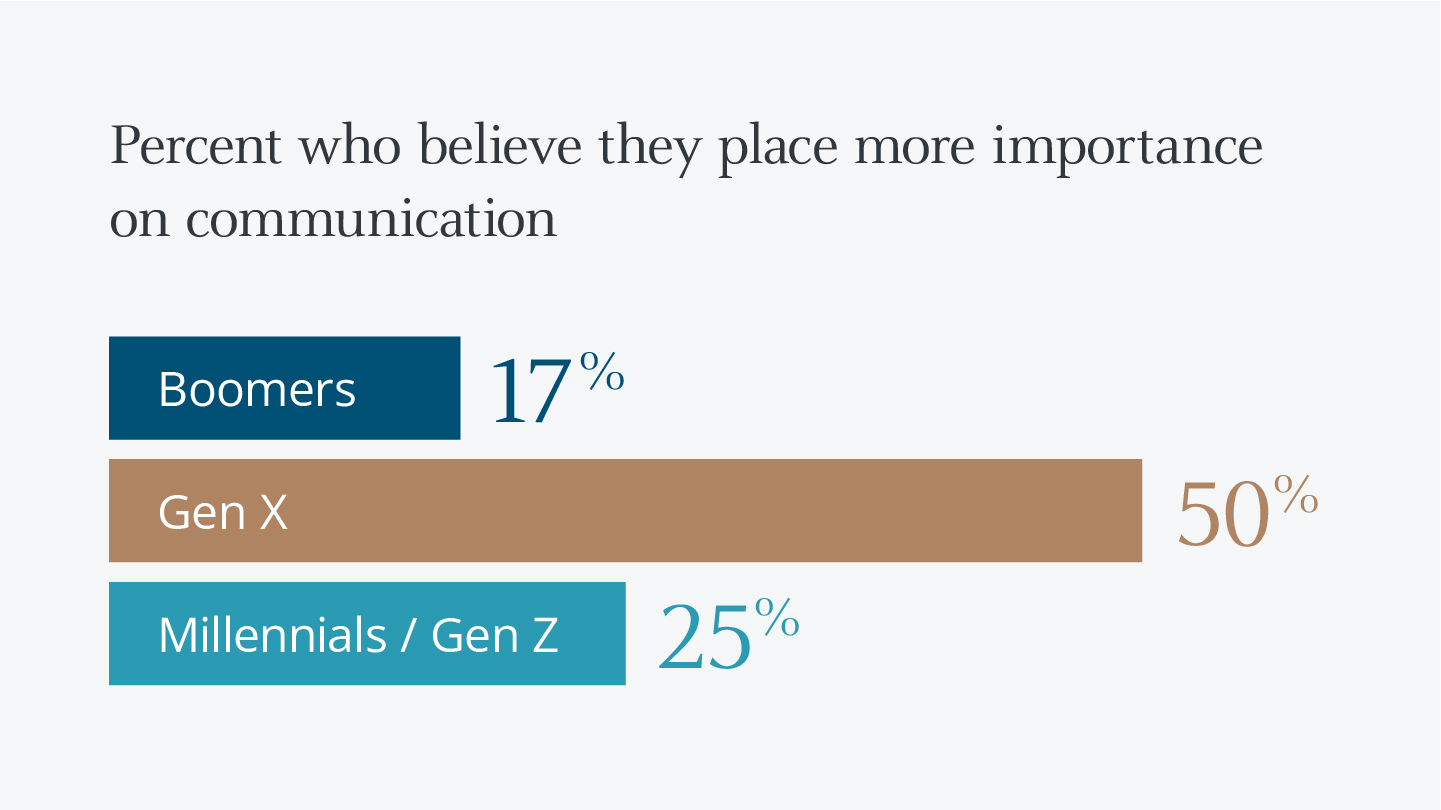

Gen X appears to mark the shift in attitudes between generations, with 50% of Gen Xers believing they place much greater importance on multigenerational communications than their predecessors. This focus on communication is driven in part by a desire for clarity. Not only do family members want to better understand their individual roles and responsibilities; they also want to understand the reasoning behind family decisions – and how those decisions reflect the family’s values.

Still, there are some topics that can be touchy for family members – for some more than others. While 46% of boomers believe nothing is off limits, 40% of Gen Xers would rather not discuss specific details of individual wealth or income. Meanwhile, 44% of millennial and Gen Z family members said they’d prefer to keep spending habits and lifestyle choices private.

Insight 4: Families need to strive for alignment

While families may think the older generation is more focused on shared values, more millennials and Gen Zers are looking for agreement; twice as many millennials and Gen Zers than boomers are seeking consensus on family values. Aligning on this, among other topics, is important to ease wealth transitions and avoid conflicts between family members.

Other areas of disagreement among families can include views on stewardship, transparency, impact and values. Aligning on these matters is important to ease wealth transitions and avoid conflicts between family members.

- Stewardship involves responsibility and preservation, ensuring the sustainability of wealth and legacy for future generations. Boomers especially prioritize preservation, seeing wealth as something to safeguard, not disrupt. This can conflict with millennials and Gen Zers, who seek flexibility and room to make bolder financial choices. For Gen X, stewardship can be a balancing act between maintaining what’s been built and teaching financial responsibility to the younger generation.

- Transparency involves sharing the right amount of information at the right time to foster trust and collaboration within families. The fear for boomers is that too much transparency can erode ambition or discourage a strong work ethic. Yet without transparency, millennial and Gen Z family members are left unsure about how to engage. Gen X seeks to bridge the gap by prioritizing transparency, involving their kids early to teach responsibility and normalize conversations about money.

- Impact involves using wealth to create positive change and support meaningful causes, reflecting the values and priorities of each generation. However, definitions of impact can vary among generations, which can cause misalignment between older generations, who prioritize long-term planning, and younger generations, who see impact as more urgent.

- For boomers, it’s about the legacy they leave behind.

- For Gen Xers, it’s about preparing the next generation.

- For millennials and Gen Zers, it’s about living their values now.

- Values involve how wealth is perceived and managed, and they can play a critical role in shaping communication within families. Millennials and Gen Zers often want to use family wealth to support their interests and passions – something boomers may view as careless or threatening to the values they worked to establish. Both boomers and Gen Xers are more likely to prioritize security, though Gen Xers seek to balance that need for stability with the desire to empower their children to explore new opportunities.

The bottom line: How to strengthen family wealth conversations

While family members can have very different ideas about wealth and how to talk about it, there is no need to be discouraged. There are steps that families can take to establish an emotionally intelligent framework for intergenerational communications.

Five steps you can take to strengthen your family conversations

Benefit: Clarity can foster engagement and collaboration.

Benefit: Personal growth and development can build confidence, openness, and inclusivity.

Benefit: Open dialogue can reduce anxiety and enhance outcomes.

Benefit: Mutual respect and trust will help ensure all family members feel valued, included and connected.

Benefit: A trusted third party can pave the way for open communication, fostering trust and collaboration.

A J.P. Morgan advisor can help families navigate the challenges of intergenerational communications. Reach out to an advisor for more information on family dynamics and family engagement and governance.

To access the full report (PDF) and more resources, please visit the J.P. Morgan Family Wealth Institute TM.

Connect with a Wealth Advisor

Reach out to your Wealth Advisor to discuss any considerations for your current portfolio. If you don’t have a Wealth Advisor, click here to tell us about your needs and we’ll reach out to you.

GENERAL RISKS & CONSIDERATIONS. Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan representative.

NON-RELIANCE. Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report. Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

Legal Entity and Regulatory Information.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

This document may provide information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (“JPMS”). The agreements entered into with JPMS, and corresponding disclosures provided with respect to the different products and services provided by JPMS (including our Form ADV disclosure brochure, if and when applicable), contain important information about the capacity in which we will be acting. You should read them all carefully. We encourage clients to speak to their JPMS representative regarding the nature of the products and services and to ask any questions they may have about the difference between brokerage and investment advisory services, including the obligation to disclose conflicts of interests and to act in the best interests of our clients.

J.P. Morgan may hold a position for itself or our other clients which may not be consistent with the information, opinions, estimates, investment strategies or views expressed in this document. JPMorgan Chase & Co. or its affiliates may hold a position or act as market maker in the financial instruments of any issuer discussed herein or act as an underwriter, placement agent, advisor or lender to such issuer.