Transfer funds, wire money, pay bills—at home, and on the go

We make it easy to manage your finances.

You can do all of this simply and securely with J.P. MorganSM and the J.P. Morgan Mobile® app1

-

Convenience

Banking on your schedule: Move money between accounts, pay people or bills, and make deposits in just minutes.

-

Control

Schedule payments and transfers and receive alerts to keep you informed of when money enters and leaves your accounts.

-

Security

Benefit from the controls and safeguards we put in place to maintain your privacy and the confidentiality of your financial information.

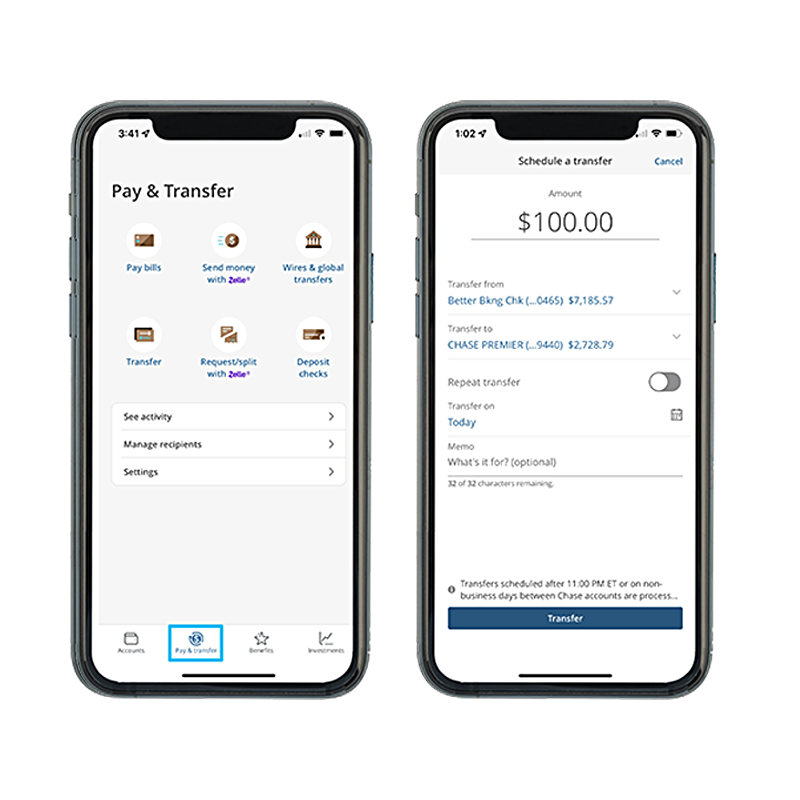

Transfer Funds

Access Money—where and when you need it. Schedule one-time or repeating transfers from one account to another, including your external accounts.

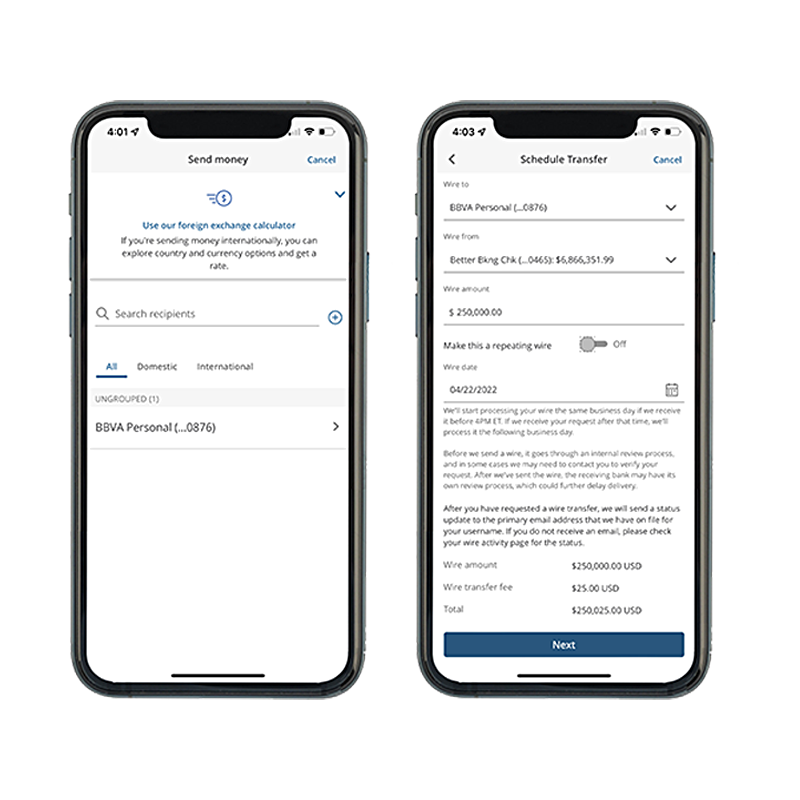

Wire money across the globe

Easily send domestic and international wires in U.S. Dollars or in select foreign currencies, and receive notifications confirming processed transfers. Plus, you can quickly import recipients whom you’ve paid before through your J.P. Morgan team, making it all the more convenient.

Keeping your account safe and secure

Cybersecurity and fraud prevention are crucial to J.P. Morgan. We are committed to safeguarding your assets and providing you with multiple ways to protect your information.

Digital capabilities designed for you.

Digital capabilities designed for you.

Security Center

Access tools to help you manage your data, protect your privacy, and keep your accounts secure. Set up alerts, manage who has access to your accounts, and more.

Transaction approval

Delegate transfer authority to trusted individuals, and activate Chase Dual ControlSM to require secondary approval for all payments and transfers.

Security insights and resources

Visit our cybersecurity and fraud prevention hub for educational materials to help protect your information, identity, and financial profile.

Send and receive money from almost anyone in the U.S. with Zelle®

Request money from and send payments to virtually anyone you know with a U.S. bank account, email address, or phone number. It’s fast and free, and payments are completed in just minutes.2

Pay and manage bills

Make payments and manage your bills in one place with just a few clicks. Set up recurring auto payments and let us do the rest.3

Deposit checks with Chase QuickDepositSM

Save a trip to the branch and deposit checks anytime using the J.P. Morgan Mobile® app on your mobile device or tablet.4

References

You can download the J.P. Morgan Mobile® app from the App Store or Google Play. App Store is a trademark of Apple Inc., registered in the United States and other countries. Android and Google Play are trademarks of Google Inc. Use of these trademarks is subject to Google Permissions. J.P. Morgan Mobile® app is available for select mobile devices. Message and data rates may apply.

Zelle®: Enrollment in Zelle® is required. Both parties need a U.S. bank account; only one needs an eligible JPMorgan Chase account. Funds are typically made available in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle (go to https://register.zellepay.com to view participating banks). Select transactions could take up to 3 business days. Enroll on the J.P. Morgan Mobile® app or through J.P. Morgan OnlineSM. Limitations may apply. Message and data rates may apply. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

J.P. Morgan OnlineSM Bill Pay: Must enroll in J.P. Morgan OnlineSM and activate Online Bill Pay. Certain restrictions and other limitations may apply.

Chase QuickDepositSM is available for select mobile devices. Enroll on the J.P. Morgan Mobile® app. Message and data rates may apply. Subject to eligibility and further review. Deposits are subject to verification and not available for immediate withdrawal. Deposit limits and other restrictions apply. See chase.com/QuickDeposit for details and eligible mobile devices.

IMPORTANT INFORMATION

Securities-based lines of credit are extended at the discretion of JPMorgan Chase Bank, N.A. (“Chase Bank”) and Chase Bank has no commitment to extend a line of credit or make loans available to you under a line of credit. Any loan extended under a securities-based line of credit is subject to credit approval by Chase Bank and, if approved, the terms and conditions contained in definitive loan documentation governing the line of credit. Proceeds from a securities-based line of credit cannot be used to purchase, carry or trade securities. A line of credit collateralized by the securities in your investment account(s) involves certain risks and may not be suitable for all borrowers. Chase Bank assigns values to these securities and, at any time and without notice to you, may increase or decrease these values or change the eligibility of these securities as collateral. A decline in the value of these securities collateralizing your securities-based line of credit (whether due to a market downturn, market volatility or otherwise) directly impacts the amount of credit available to you and may require you to provide additional collateral and/or pay down your line of credit in order to avoid the forced sale of these securities by Chase Bank. The securities in your account may be sold to meet a collateral shortfall, and Chase Bank may sell your securities without contacting you. Some or all of the securities sold to meet a collateral shortfall may be sold at prices higher than their initial cost, which may result in adverse tax consequences. You should consult your tax advisor to fully understand the tax implications associated with pledging securities in connection with a loan. Please review these and other risks in more detail with your advisor, and make sure to read your line of credit documentation carefully so that you fully understand your obligations and the risks associated with this opportunity. An exercise of remedies by Chase Bank in connection with your securities-based line of credit may a ect the performance of your investment management or investment advisory account(s), and may cause such accounts to no longer conform to applicable investment guidelines. When selling securities, Chase Bank is not required to act in accordance with any fiduciary duty Chase Bank and its a liates might otherwise have as your investment manager or investment advisor. It is important to note that Chase Bank and its a liates may earn more if you borrow against your securities and other assets rather than liquidate assets to meet your cash needs. The Secured Overnight Financing Rate (“SOFR”) is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities. The SOFR is published by the Federal Reserve Bank of New York and is determined based on certain transactions in the U.S. dollar Treasury repo market. Since the SOFR is an overnight rate, it is published every Banking Day, but is e ective for the Banking Day prior to the date of publication. Refer to your definitive loan documentation for a definition of “Banking Day.” Because the SOFR is administered by the Federal Reserve Bank of New York, the Bank has no control over its determination, calculation or publication, and the Federal Reserve Bank of New York may alter the methods of calculation, publication schedule, rate revision practices or availability of the SOFR at any time without notice. The SOFR is a floating interest rate option, and changes in the SOFR can lead to a higher or lower cost of borrowing.

LEARN MORE ABOUT OUR FIRM AND INVESTMENT PROFESSIONALS AT FINRA BROKERCHECK.

To learn more about J.P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS (PDF) and Guide to Investment Services and Brokerage Products.

This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation.

This website provides information about the brokerage and investment advisory services provided by J.P. Morgan Securities LLC (JPMS). When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. A client should carefully read the agreements and disclosures received (including our Form ADV disclosure brochure, if and when applicable) in connection with our provision of services for important information about the capacity in which we will be acting.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA, and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. Member FDIC. This is not a commitment to lend. All extensions of credit are subject to credit approval. Bank products and services are offered by JPMorgan Chase Bank, N.A. and its bank affiliates.

Investments in alternative investment strategies is speculative, often involves a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by sophisticated investors with the financial capability to accept the loss of all or part of the assets devoted to such strategies.

Borrowing with securities as collateral involves certain risks, including the possibility that you may need to deposit additional securities and/or cash in the account to meet a maintenance call, and that securities in the account may be sold to meet the maintenance call. Proper management of your account and a thorough understanding of the conditions that may affect your investments will assist you in effectively using the margin lending program.

Please read additional Important Information in conjunction with these pages.

INVESTMENT AND INSURANCE PRODUCTS ARE:

• NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED